Alkane Resources Limited

29.1.2026 23:05:53 CET | Globenewswire | Press release

Record quarterly production & operational cash build

Record quarterly production & operational cash build

Cash & Bullion $232 million – $58 million increase for the quarter

PERTH, Australia, Jan. 29, 2026 (GLOBE NEWSWIRE) -- Alkane Resources Limited (ASX:ALK; TSX:ALK; OTCQX:ALKEF) (‘Alkane’ or ‘the Company’) is pleased to present its Quarterly Activities Report for the period ending 31 December 2025 (‘Q2 FY26’):

Operations

- Site operating cash flow of $133 million for the quarter.

- An additional $18 million payment was received in early January from a Costerfield concentrate shipment that shipped in mid-December with payment receipt delayed due to the Christmas holidays.

- Q2 FY26 record gold production of 43,663 AuEq oz @ AISC of $2,739/AuEq oz.1,2

- Full Year Group Guidance on track for 160-175kozs AuEq at AISC $2,600-2,900/AuEq oz reflects production from Costerfield and Björkdal from July 2025.3

- In early October Tomingley awarded the final portion of the contract to construct the Newell Highway re-alignment. Construction is expected to complete in the first half of 2027.

Exploration

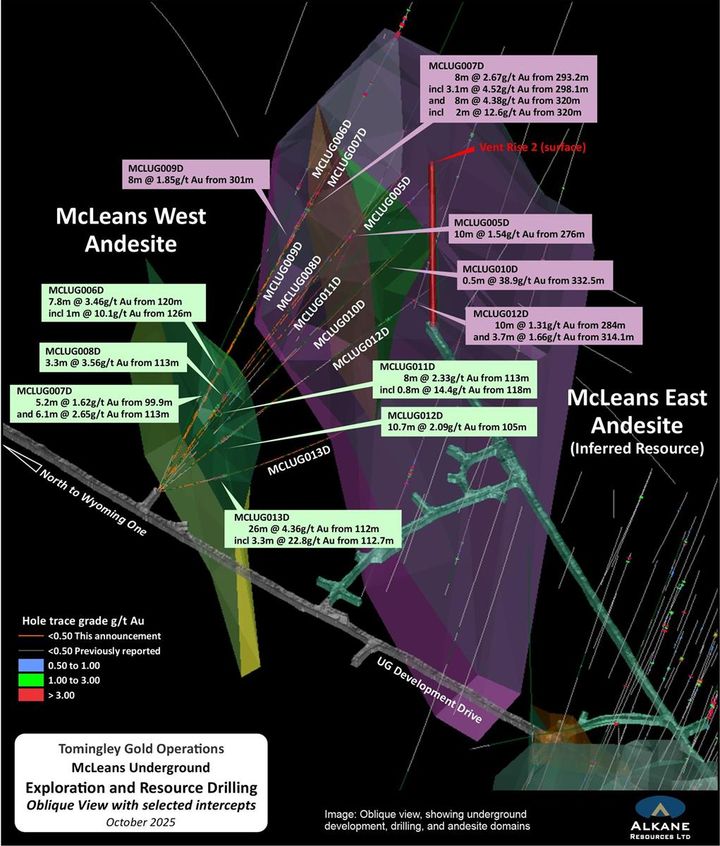

- Extension drilling at Storheden (part of Björkdal property) doubled depth extent to 464m and strike extent to 2.7km of the known system including intercepts of 142.0 g/t gold over 0.60 m (Estimate True Width 0.25 m) and 111.0 g/t gold over 0.50 m (ETW 0.25 m).4

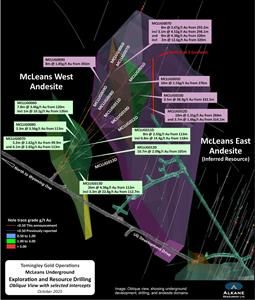

- At Tomingley a gold rich domain was discovered adjacent to McLeans and close to current underground infrastructure. Assays highlights from the drilling include; 4.36g/t gold over 26m including 22.8 g/t gold over 3.3m.5

Finance and Corporate

- Gold equivalent sales for the quarter of 44,084 ounces1 for revenue of $256 million at an average gold price of $5,785/oz and an average antimony price of $41,510/t.

- Cash, bullion and listed investment balance of $246 million after $17 million of corporate income tax payments during the quarter.

- 8,200 ounces of hedges filled during the quarter.

Managing Director, Nic Earner, commented: “It has been an excellent quarter for Alkane, producing 42,767 ounces of gold and 267 tonnes of antimony (43,663 ounces of gold equivalent) over the full quarter.1, Our site operating cashflow was $133 million for the quarter, resulting in a balance sheet with $246 million in cash, bullion and listed investments at quarter end. Our full year guidance of 160-175kozs gold equivalent remains unchanged.3”

GROUP SUMMARY STATUTORY REPORTING PERIOD1,2

Gold-Antimony Production

Alkane produced 42,767 ounces of gold and 267 tonnes of antimony in Q2 FY26, its highest quarterly gold and antimony production yet, resulting in a Group record quarterly production of 43,663 gold equivalent ounces (Q1 FY26: 30,511 AuEq oz) at an AISC of $2,739/AuEq oz (Q1 FY26: $2,988/AuEq oz). The production during the quarter was significantly higher than Q1 FY26, driven by improved output at Tomingley and 3 full months of production from Björkdal and Costerfield as compared to only 2 months of reported production in the previous quarter following the merger with Mandalay completing in early August 2025.

Alkane processed 683,235 tonnes of ore in total at an average gold grade of 2.20g/t Au producing 42,767oz of gold. Tomingley processed 318,851 tonnes of ore with an average gold grade of 2.50/t. At Costerfield, the average grade of gold was 10.44g/t and the average grade of antimony was 0.91% over 34,732 tonnes of ore processed while Björkdal processed 329,652 tonnes of ore with an average gold grade of 1.04g/t.

| Table 1: December quarter 2025 operational performance summary | |||||||||

| Operations | Units | Costerfield | Tomingley | Björkdal | Total | ||||

| Ore mined | t | 39,698 | 275,079 | 266,217 | 580,994 | ||||

| Mined ore gold grade | g/t | 8.36 | 2.61 | 1.27 | 2.39 | ||||

| Mined ore antimony grade | % | 0.93 | - | - | 0.93 | ||||

| Processed ore | t | 34,732 | 318,851 | 329,652 | 683,235 | ||||

| Processed ore - milled head grade gold | g/t | 10.44 | 2.50 | 1.04 | 2.20 | ||||

| Processed ore - milled head grade antimony | % | 0.91 | - | - | 0.91 | ||||

| Recovery gold | % | 93.94 | % | 89.84 | % | 87.43 | % | 90.40 | % |

| Recovery antimony | % | 86.77 | % | - | - | 86.77 | % | ||

| Gold produced | oz | 10,790 | 22,089 | 9,888 | 42,767 | ||||

| Antimony produced | t | 267 | - | - | 267 | ||||

| Gold equivalent produced | oz | 11,686 | 22,089 | 9,888 | 43,663 | ||||

| Ore stockpiles - contained gold | oz | 7,823 | 7,597 | 20,443 | 35,864 | ||||

| Ore stockpiles - contained antimony | t | 349 | - | - | 349 | ||||

| Gold equivalent in circuit, finished concentrate and bullion | oz | 3,432 | 2,171 | 1,938 | 7,541 | ||||

| 3,364 | |||||||||

| Table 2: FY26 statutory reporting period operational performance summary6 | |||||||||

| Operations | Units | Costerfield | Tomingley | Björkdal | Total | ||||

| Ore mined | t | 64,530 | 576,771 | 419,520 | 1,060,821 | ||||

| Mined ore gold grade | g/t | 8.42 | 2.43 | 1.27 | 2.33 | ||||

| Mined ore antimony grade | % | 0.86 | - | - | 0.86 | ||||

| Processed ore | t | 57,403 | 633,821 | 563,441 | 1,254,664 | ||||

| Processed ore - milled head grade gold | g/t | 9.67 | 2.33 | 1.00 | 2.07 | ||||

| Processed ore - milled head grade antimony | % | 0.82 | - | - | 0.82 | ||||

| Recovery gold | % | 93.45 | % | 87.81 | % | 86.68 | % | 89.31 | % |

| Recovery antimony | % | 84.85 | % | - | - | 84.85 | % | ||

| Gold produced | oz | 16,433 | 40,424 | 15,875 | 72,732 | ||||

| Antimony produced | t | 391 | - | - | 391 | ||||

| Gold equivalent produced | oz | 17,875 | 40,424 | 15,875 | 74,174 | ||||

| Ore stockpiles - contained gold | oz | 7,823 | 7,597 | 20,443 | 35,864 | ||||

| Ore stockpiles - contained antimony | t | 349 | - | - | 349 | ||||

| Gold equivalent in circuit, finished concentrate and bullion | oz | 3,432 | 2,171 | 1,938 | 7,541 | ||||

Revenue

Gold equivalent sales for the quarter of 44,084 ounces1 (Q1 FY26: 30,010 AuEq oz) for revenue of $256 million (Q1 FY26: $147m) at an average gold price of $5,785/oz (Q1 FY26: $4,896/oz) and an average antimony price of $41,510/t (Q1 FY26: $35,646/oz). The increase in revenue was mainly due to the Group’s increased gold sales volume following the improved production output at Tomingley and the inclusion of 3 full months of production at Björkdal and Costerfield, combined with the higher gold price. Revenue from Tomingley includes 8,200 ounces delivered into forward contracts at $2,843/ounce.

Björkdal´s average realised gold price at $6,930/oz is a simple average for the quarter of revenue divided by ounces sold for the quarter. Sales revenue for the quarter at Björkdal includes adjustments to provisionally priced concentrate sales which are then revalued at each reporting date (by using the current market price at the end of each reporting period). The gold price increased notably during the quarter leading to the recognition of $9 million additional revenue without recognising additional ounces, therefore increasing the realised gold price per ounce.

Operating Costs, Cash Operating Costs per Gold Equivalent Ounce Produced, All-In Sustaining Costs (“AISC”) per Gold Equivalent Ounce Produced and Capital Expenditures

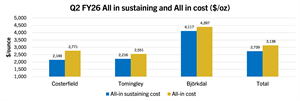

Group AISC was $2,739/AuEq oz for the quarter and group cash costs were $2,031/AuEq oz for the quarter. These were lower than Q1 FY26 AISC of $2,988/AuEq oz and operating cash costs of $2,215/AuEq oz primarily due to planned higher grades at Tomingley and Costerfield resulting in higher increased gold equivalent production.

Total operations sustaining, growth and exploration expenditure during Q2 FY26 was $38 million.

Sustaining capital was $20 million. This included $10 million for capital development mainly at Björkdal and $4 million for mining ancillary equipment purchases at Tomingley and Björkdal.

Growth capital of ~$9 million was mainly at Tomingley for the Newell Highway realignment. This project is due for completion in the first half of 2027.

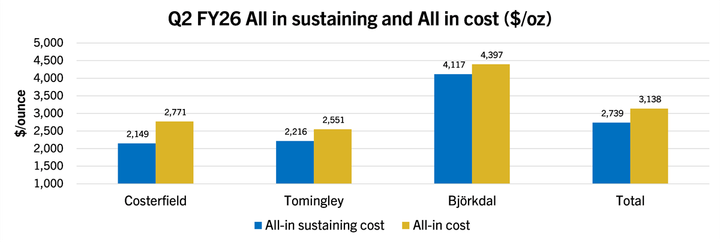

Exploration expenditure of ~$8 million was split between $6 million at Costerfield and $2 million at Björkdal and Tomingley. Costerfield drilling was predominantly close to the operating mine with the Brunswick South, Sub KC and Kendal drilling programs progressed with the aim to add immediate mine life. Three drill rigs also progressed the True Blue program with predominantly infill drilling.

Newell Highway works looking east.

| Table 3: December quarter 2025 financial performance summary | |||||||||

| Financials | Units | Costerfield | Tomingley | Björkdal | Total | ||||

| Gold equivalent sold | oz | 12,417 | 22,491 | 9,176 | 44,084 | ||||

| Average realised gold price | $/oz | 6,333 | 5,048 | 6,930 | 5,785 | ||||

| Average realised antimony price | $/t | 41,510 | - | - | 41,510 | ||||

| Revenue for the quarter | $'000 | 79,026 | 113,534 | 54,827 | 247,386 | ||||

| Gold provisional pricing adjustments | $'000 | 1,496 | - | 8,758 | 10,254 | ||||

| Antimony provisional pricing adjustments | $'000 | (1,141 | ) | - | - | (1,141 | ) | ||

| Total revenue from mining operations | $'000 | 79,380 | 113,534 | 63,585 | 256,498 | ||||

| Mining | $'000 | 12,530 | 23,532 | 16,873 | 52,934 | ||||

| Processing | $'000 | 3,733 | 13,779 | 7,391 | 24,903 | ||||

| G&A | $'000 | 3,614 | 2,699 | 4,514 | 10,826 | ||||

| Cash cost | $'000 | 19,877 | 40,009 | 28,777 | 88,663 | ||||

| Inventory movements | $'000 | (475 | ) | 1 | (879 | ) | (1,353 | ) | |

| Royalties | $'000 | 1,908 | 3,806 | 79 | 5,792 | ||||

| Corporate costs | $'000 | - | - | - | 4,813 | ||||

| Rehabilitation | $'000 | 623 | 606 | 181 | 1,409 | ||||

| Sustaining Capital | $'000 | 3,182 | 4,522 | 12,553 | 20,257 | ||||

| All-in sustaining cost | $'000 | 25,115 | 48,944 | 40,710 | 119,582 | ||||

| Exploration | $'000 | 5,884 | 1,013 | 1,126 | 8,023 | ||||

| Growth capital | $'000 | 1,385 | 6,389 | 1,640 | 9,414 | ||||

| All-in cost | $'000 | 32,384 | 56,346 | 43,476 | 137,019 | ||||

| Gold produced | oz | 10,790 | 22,089 | 9,888 | 42,767 | ||||

| Antimony produced | t | 267 | - | - | 267 | ||||

| Gold equivalent produced | oz | 11,686 | 22,089 | 9,888 | 43,663 | ||||

| Cash cost | $/oz | 1,701 | 1,811 | 2,910 | 2,031 | ||||

| All-in sustaining cost | $/oz | 2,149 | 2,216 | 4,117 | 2,739 | ||||

| All-in cost | $/oz | 2,771 | 2,551 | 4,397 | 3,138 | ||||

| Mine operating cash flow | $'000 | 29,822 | 67,299 | 35,379 | 132,500 | ||||

| Table 4: FY26 statutory reporting period financial performance summary6 | |||||||||

| Financials | Units | Costerfield | Tomingley | Björkdal | Total | ||||

| Gold equivalent sold | oz | 17,690 | 40,947 | 15,457 | 74,094 | ||||

| Average realised gold price | $/oz | 6,035 | 4,703 | 6,688 | 5,225 | ||||

| Average realised antimony price | $/t | 40,254 | - | - | 40,254 | ||||

| Revenue for the quarter | $'000 | 107,387 | 192,591 | 89,213 | 389,191 | ||||

| Gold provisional pricing adjustments | $'000 | 1,736 | - | 14,163 | 15,899 | ||||

| Antimony provisional pricing adjustments | $'000 | (1,363 | ) | - | - | (1,363 | ) | ||

| Total revenue from mining operations | $'000 | 107,759 | 192,591 | 103,376 | 403,727 | ||||

| Mining | $'000 | 19,494 | 46,097 | 27,254 | 92,845 | ||||

| Processing | $'000 | 6,284 | 26,324 | 11,367 | 43,975 | ||||

| G&A | $'000 | 6,022 | 6,452 | 6,950 | 19,424 | ||||

| Cash cost | $'000 | 31,800 | 78,872 | 45,571 | 156,243 | ||||

| Inventory movements | $'000 | (716 | ) | 914 | (1,644 | ) | (1,446 | ) | |

| Royalties | $'000 | 2,905 | 6,411 | 164 | 9,481 | ||||

| Corporate costs | $'000 | - | - | - | 8,625 | ||||

| Rehabilitation | $'000 | 636 | 1,422 | 214 | 2,272 | ||||

| Sustaining Capital | $'000 | 5,658 | 9,510 | 20,412 | 35,580 | ||||

| All-in sustaining cost | $'000 | 40,283 | 97,130 | 64,717 | 210,756 | ||||

| Exploration | $'000 | 9,582 | 1,395 | 2,673 | 13,650 | ||||

| Growth capital | $'000 | 1,508 | 12,418 | 1,640 | 15,566 | ||||

| All-in cost | $'000 | 51,373 | 110,943 | 69,029 | 239,971 | ||||

| Gold produced | oz | 16,433 | 40,424 | 15,875 | 72,732 | ||||

| Antimony produced | t | 391 | - | - | 391 | ||||

| Gold equivalent produced | oz | 17,875 | 40,424 | 15,875 | 74,174 | ||||

| Cash cost | $/oz | 1,779 | 1,951 | 2,871 | 2,106 | ||||

| All-in sustaining cost | $/oz | 2,254 | 2,403 | 4,077 | 2,841 | ||||

| All-in cost | $/oz | 2,874 | 2,745 | 4,348 | 3,235 | ||||

| Mine operating cash flow | $'000 | 50,011 | 106,411 | 51,288 | 207,709 | ||||

Cash flow

Alkane closed the quarter with cash, bullion and liquid investments of $246 million – comprising $218 million in total cash, bullion ($14 million) and liquid investments ($14 million). This result was driven by record Group gold sales at 44,084 gold equivalent ounces and an increase in realised gold price to $5,785/oz (Q1 FY26: $4,896/oz) and a realised antimony price of $41,510/t (Q1 FY26: $35,646/t) generating $256 million in revenue. Alkane´s operations generated $133 million of mine operating cashflows with the achieved gold price $3,046/AuEq oz over AISC.

Tax outflows were $17 million during the quarter, $11 million of which related to FY25 on completion of the tax return with the remainder being monthly instalments on future tax obligations. Corporate and other cashflows were $20 million. This includes $7 million of corporate cash outflows, $6 million for a cash backed bond related to the Newell Highway project, $3 million of Boda & regional NSW exploration and $2 million on Lupin closure costs. Notably, an additional $18 million payment was received in early January from a Costerfield concentrate shipment that shipped in mid-December with payment receipt delayed due to the Christmas holidays.

OPERATIONS AND PROJECTS

Costerfield Gold-Antimony Operations - Victoria

Mandalay Resources Costerfield Operations Pty Ltd (100%)

Costerfield Gold-Antimony Operations (Costerfield) is a wholly owned operation of Alkane. Costerfield is located within the Costerfield mining district of Central Victoria, Australia, approximately 10 km northeast of the town of Heathcote and 50 km east of the city of Bendigo.

The property encompasses the underground infrastructure supporting the Augusta, Cuffley, Brunswick, Youle and Shepherd deposits; the Augusta Mine Site (Augusta), the Brunswick Processing Plant; the Splitters Creek Evaporation Facility; the Brunswick and Bombay Tailings Storage Facilities (TSF) and associated infrastructure.

Operations Performance

Costerfield delivered steady operational performance during the quarter, with both ore mining and milling rates being in excess of budget. Mining continued to focus on achieving mining of planned high priority areas, with some variability in stope performance due to challenging ground conditions and overbreak in complex shallow dipping parts of the orebody in the Youle-Shepherd transition. The operation continues to work on targeted improvement programs including drill and blast optimisation, enhanced operator training, and the move to emulsion explosives to improve recovery and reduce dilution.

Processing focused on blend control to maximise throughput, recoveries and produced metal. Trials will occur in Q3 to determine potential benefits of pre crushing ore feed to further improve throughput, crusher downtime and blend control.

Processing operations performed reliably, with higher mill throughput supported by improved crushing circuit availability. Continuous optimisation of blending and recovery continue to be a focus. Work continues to prioritise operational consistency across all aspects of the operation.

A total of 11,686 gold equivalent ounces1 was produced during the quarter (Q1 FY26: 6,189 AuEq oz). The site cash costs for the quarter were $1,701/AuEq oz (Q1 FY26: $1,927/AuEq oz) with an AISC of $2,149/AuEq oz (Q1 FY26: $2,451/AuEq oz).2 Gold sold for the quarter was 11,042 ounces at an average sales price of $6,333/oz and antimony sold for the quarter was 409 tonnes (228 tonnes post payability) at an average sales price of $41,510/t, generating revenue of $79 million. Finished product stocks were 3,364 ounces. The site’s operating cash flow was $30 million for the quarter.

Exploration

At Costerfield during Q2 FY26, near mine drilling continued on three main focus areas. Brunswick South drilling looked to build on high grade intercepts discovered earlier in the year with a progression to infill drilling late in the quarter. The Kendall drilling program explored a series of veins above the currently active Youle, and the Sub KC drilling aimed to both infill and extend mineral resources below the Cuffley and Augusta workings.

Additionally True Blue was progressed with three diamond rigs predominantly focused on infill drilling.

Geological map of Costerfield showing areas of exploration during Q2 FY26.

Tomingley Gold Operations - NSW

Tomingley Gold Operations Pty Ltd (100%)

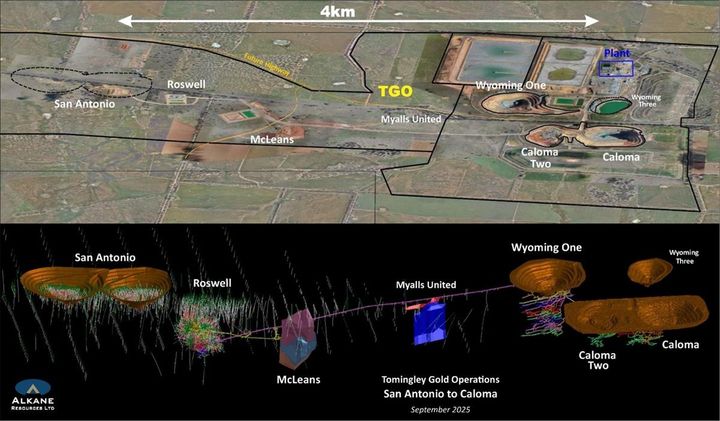

Tomingley Gold Operations (Tomingley) is a wholly owned operation of Alkane, located near the village of Tomingley, approximately 50km southwest of Dubbo in Central Western New South Wales. Tomingley has been operating since 2014. Mining occurs underground on four gold deposits (Wyoming One, Caloma One, Caloma Two and Roswell).

Operations Performance

The primary source of ore continues to be from Roswell. During the quarter the ore production was constrained primarily due to multiple smaller issues including shotcreter downtime delaying paste fill, lower development led to lower development ore, and redesigned stope shape for lode recovery.

Processing continues to perform well with milling in excess of budget primarily as a result of the insertion of a mobile crusher to pre-crush material prior to entering the processing circuit. Mill grade and recovery were as per budget. Pre-crushing of material to sub 10mm prior to entering the circuit has seen a nominal increase in milling rates to approximately 1.3mtpa, work is continuing in this area.

A total of 22,089 ounces of gold was poured for the quarter (Q1 FY26: 18,335oz). The site cash costs for the quarter were $1,811/oz (Q1 FY26: $2,120/oz) with an AISC of $2,216/oz (Q1 FY26: $2,628/oz).2 Gold sold for the quarter was 22,491 ounces at an average sales price of $5,048/oz, generating revenue of $114 million. Bullion stocks were 2,171 ounces. The site’s operating cash flow was $67 million for the quarter.

Works continued on the Newell Highway diversion during the quarter with approximately 3.5kms of pavement established to varying thicknesses prior to the Christmas shutdown (19 December 2025). Work commenced on the Kenilworth access, required to allow heavy vehicle access into site and is expected to be completed late January 2026.

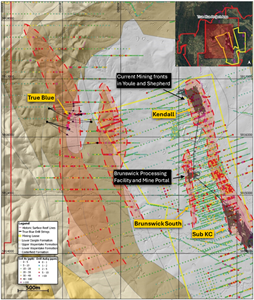

Exploration

Resource expansion drilling continues at Tomingley outside existing resources and nearby to underground infrastructure. The drilling has led to discovering a new zone of mineralisation that is associated with a second andesite host at McLeans. The recently discovered Western Andesite is intersected by several drill holes returning significant gold intercepts including drill hole MCLUG013D with 26m grading 4.36g/t Au including 3.3m grading 22.8g/t Au (see ASX Announcement dated 3 November 2025 and titled ‘Tomingley Drilling Discovers New Mineralisation at McLeans’)

Björkdal Gold Operations - Sweden

Björkdalsgruvan AB (100%)

Björkdal Gold Operations (Björkdal) is a wholly owned operation of Alkane. The Björkdal property, containing both the Björkdal mine and the Storheden and Norrberget deposits, is located in Västerbotten County in northern Sweden. Björkdal is located approximately 28 km northwest of the municipality of Skellefteå and approximately 750 km north of Stockholm. The Björkdal property is accessible via Swedish national road 95 or European highway route E4 followed by all-weather paved roads.

Operations Performance

Björkdal delivered another quarter of solid mining performance with ore production supported by consistent stope productivity and stable development activities. The operation also benefited from planned replacements of critical equipment, which improved machine availability. However, certain equipment deliveries were postponed by manufacturers and are now expected in the March 2026 quarter.

Mill throughput was slightly lower than the previous quarter, primarily due to mill linings not wearing at the anticipated rate, which limited the maximum allowable mill load. The completion and commissioning of the return water system from the mine has had a positive impact on flotation performance to date. The more stable water temperature compared with variable temperatures in river-sourced raw water enhanced process stability. This new water redundancy also reduces the mill’s vulnerability to seasonal fluctuations in river conditions. The operation achieved improved recoveries during the quarter as a result.

A total of 9,888 gold ounces was produced during the quarter (Q1 FY26: 5,987oz). The site cash costs for the quarter were $2,910/oz (Q1 FY26: $2,805/oz) with an AISC of $4,117/oz (Q1 FY26: $4,010/oz).2 Gold sold for the quarter was 9,176 ounces at an average sales price of $6,930/oz, generating revenue of $64 million. Finished product stocks were 1,938 ounces. The site’s operating cash flow was $35 million for the quarter.

Exploration

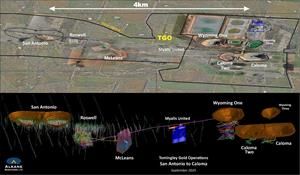

At Björkdal there were two programs progressed during the quarter. Both programs aim to extend the orebody that is currently being mined with the focus on the northern and eastern depth extensions.

Additionally, in December, the results of the recent Storheden drilling were released (see ASX announcement dated 19 December 2025 and titled ‘Alkane Doubles the Tested Depth Extent of the Storheden Deposit at Björkdal’). Highlights of the release include an extension of the known depth to 464m and Strike length to 2.7km with a series of Björkdal style veins interpreted across three main target domains. Assays highlights include, 142.0 g/t gold over 0.60 m (Estimate True Width 0.25 m) and 111.0 g/t gold over 0.50 m (ETW 0.25 m).

Excerpt from the Storheden news release showing significant recent drilling results. Selected significant intercepts are annotated.

Northern Molong Porphyry Project (NMPP) (gold-copper)

Alkane Resources Ltd 100%

During the quarter, exploration recommenced with the flying of a MobileMT survey over the majority of the NMPP. Inversion and interpretation of the MMT survey data is ongoing. Reconnaissance drilling for a total 4,500 metres commenced late in the quarter with the mobilisation of one air-core, one high-capacity RC, and one diamond core drill rigs. Exploration results are expected to be reported in Q3.

Environmental baseline studies to inform the development approval of the Boda-Kaiser Au-Cu resources continued in the quarter.

Lupin Reclamation Project

Lupin Mines Inc 100%

Lupin is currently in the process of final closure and reclamation activities which are to be partially funded by progressive security reductions. During the quarter, there has been minor spend on engineering, project management, coordination, site activities and equipment maintenance.

The majority of this reclamation work to achieve the majority of closure obligations is expected to take place in the 2026 calendar year. As at 31 December 2025, $12 million in restricted cash stands as a deposit against the present value of certain reclamation cost obligations.

La Quebrada Exploration Project

Minera Mandalay Limitada 100%

The Company continues to evaluate options for this non-core asset.

CORPORATE

| Cash, Bullion and Listed Investments | |||

| Units | Q1 2026 | Q2 2026 | |

| Cash | $M | 160 | 218 |

| Bullion | $1M | 14 | 14 |

| Cash and bullion sub-total | $M | 174 | 232 |

| Listed Investments | $M | 17 | 14 |

| Total cash, listed investments and bullion | $M | 191 | 246 |

Banking Facilities

At the end of the quarter, the Company had $22 million of mobile equipment financing. Alkane previously had a Project Loan Facility from Macquarie Bank Limited (Macquarie) to develop the Tomingley Gold Extension Project. This facility was repaid during Q1 FY26 ($45 million).

Investments

At the end of the quarter, Alkane held ~9 million shares in Sky Metals (ASX:SKY) valued at $0.7 million and 30 million shares (~4.9%) in Medallion Metals Limited (ASX:MM8) valued at $13.1 million.

| Gold Forward Sale Contracts | ||

| Tomingley holds the following forward sale contracts: | ||

| Quarter | Average Forward Price $/oz | Ounces |

| Mar-26 | 2,855 | 8,700 |

| Jun-26 | 2,870 | 8,500 |

| Sep-26 | 2,884 | 7,500 |

| Dec-26 | 2,896 | 7,200 |

| Mar-27 | 2,821 | 7,300 |

| Jun-27 | 2,844 | 6,650 |

| Total | 2,862 | 46,150 |

During the quarter, 42,000oz of SEK put options were purchased for the Björkdal operation covering production from Jan 2026 to Dec 2026 at a strike price of SEK 30,645/oz (~$4,985/oz).

| Share Capital | |

| Alkane closed the quarter with the following capital structure: | |

| As at 30 December 2025 | |

| Fully Paid Ordinary Shares | 1,365,794,967 |

| Performance Rights | 11,611,616 |

| Total | 2,862 |

GROUP SUMMARY FULL YEAR1,2,6

| Table 5: FY26 operational performance summary | |||||||||

| Operations | Units | Costerfield | Tomingley | Björkdal | Total | ||||

| Ore mined | t | 74,532 | 576,771 | 488,560 | 1,139,863 | ||||

| Mined ore gold grade | g/t | 8.43 | 2.43 | 1.24 | 2.31 | ||||

| Mined ore antimony grade | % | 0.83 | - | - | 0.83 | ||||

| Processed ore | t | 69,567 | 633,821 | 684,000 | 1,387,388 | ||||

| Processed ore - milled head grade gold | g/t | 9.39 | 2.33 | 0.97 | 2.01 | ||||

| Processed ore - milled head grade antimony | % | 0.82 | - | - | 0.82 | ||||

| Recovery gold | % | 93.30 | % | 87.81 | % | 85.93 | % | 89.01 | % |

| Recovery antimony | % | 84.74 | % | - | - | 84.74 | % | ||

| Gold produced | oz | 19,402 | 40,424 | 18,468 | 78,294 | ||||

| Antimony produced | t | 465 | - | - | 465 | ||||

| Gold equivalent produced | oz | 21,178 | 40,424 | 18,468 | 80,070 | ||||

| Ore stockpiles - contained gold | oz | 7,823 | 7,597 | 20,443 | 35,864 | ||||

| Ore stockpiles - contained antimony | t | 349 | - | - | 349 | ||||

| Gold equivalent in circuit, finished concentrate and bullion | oz | 3,432 | 2,171 | 1,938 | 7,541 | ||||

| Table 6: FY26 financial performance summary | |||||||||

| Financials | Units | Costerfield | Tomingley | Björkdal | Total | ||||

| Gold equivalent sold | oz | 20,674 | 40,947 | 17,422 | 79,043 | ||||

| Average realised gold price | $/oz | 5,907 | 4,703 | 6,527 | 5,416 | ||||

| Average realised antimony price | $/t | 43,026 | - | - | 43,026 | ||||

| Revenue | $'000 | 124,158 | 192,591 | 113,708 | 430,457 | ||||

| Mining | $'000 | 23,616 | 46,097 | 31,662 | 101,375 | ||||

| Processing | $'000 | 8,051 | 26,324 | 13,397 | 47,772 | ||||

| G&A | $'000 | 7,269 | 6,452 | 8,238 | 21,960 | ||||

| Cash cost | $'000 | 38,936 | 78,872 | 53,298 | 171,107 | ||||

| Inventory movements | $'000 | 19 | 914 | (580 | ) | 353 | |||

| Royalties | $'000 | 3,136 | 6,411 | 184 | 9,731 | ||||

| Corporate costs | $'000 | - | - | - | 8,625 | ||||

| Rehabilitation | $'000 | 642 | 1,422 | 229 | 2,294 | ||||

| Sustaining Capital | $'000 | 6,778 | 9,510 | 22,330 | 38,619 | ||||

| All-in sustaining cost | $'000 | 49,512 | 97,130 | 75,461 | 230,729 | ||||

| Exploration | $'000 | 11,337 | 1,395 | 3,142 | 15,874 | ||||

| Growth capital | $'000 | 1,508 | 12,418 | 1,640 | 15,566 | ||||

| All-in cost | $'000 | 62,357 | 110,943 | 80,242 | 262,168 | ||||

| Gold produced | oz | 19,402 | 40,424 | 18,468 | 78,294 | ||||

| Antimony produced | t | 465 | - | - | 465 | ||||

| Gold equivalent produced | oz | 21,178 | 40,424 | 18,468 | 80,070 | ||||

| Cash cost | $/oz | 1,839 | 1,951 | 2,886 | 2,137 | ||||

| All-in sustaining cost | $/oz | 2,338 | 2,403 | 4,086 | 2,882 | ||||

| All-in cost | $/oz | 2,944 | 2,745 | 4,345 | 3,274 | ||||

| Mine operating cash flow | $'000 | 53,822 | 106,411 | 44,213 | 204,446 | ||||

This document has been authorised for release to the market by Nic Earner, Managing Director.

ABOUT ALKANE ‐ alkres.com ‐ ASX:ALK | TSX: ALK | OTCQX: ALKEF

Alkane Resources (ASX:ALK; TSX:ALK; OTCQX:ALKEF) is an Australia-based gold and antimony producer with a portfolio of three operating mines across Australia and Sweden. The Company has a strong balance sheet and is positioned for further growth.

Alkane’s wholly owned producing assets are the Tomingley open pit and underground gold mine southwest of Dubbo in Central West New South Wales, the Costerfield gold and antimony underground mining operation northeast of Heathcote in Central Victoria, and the Björkdal underground gold mine northwest of Skellefteå in Sweden (approximately 750km north of Stockholm). Ongoing near-mine regional exploration continues to grow resources at all three operations.

Alkane also owns the very large gold-copper porphyry Boda-Kaiser Project in Central West New South Wales and has outlined an economic development pathway in a Scoping Study. The Company has ongoing exploration within the surrounding Northern Molong Porphyry Project and is confident of further enhancing eastern Australia’s reputation as a significant gold, copper and antimony production region.

Competent Person

As an Australian Company with securities listed on the Australian Securities Exchange (ASX), Alkane is subject to Australian disclosure requirements and standards, including the requirements of the Corporations Act 2001 and the ASX. Investors should note that it is a requirement of the ASX Listing Rules that the reporting of ore reserves and mineral resources in Australia is in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code) and that Alkane's ore reserve and mineral resource estimates and reporting comply with the JORC Code.

Alkane is also subject to certain Canadian disclosure requirements and standards as a result of its secondary listing on the Toronto Stock Exchange (TSX), including the requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). Investors should note that it is a requirement of Canadian securities law that the reporting of mineral reserves and mineral resources in Canada and the disclosure of scientific and technical information concerning a mineral project on a property material to Alkane comply with NI 43-101.

Unless otherwise advised above or in the ASX Announcements referenced, the information in this report that relates to exploration results, mineral resources and ore reserves is based on information compiled by Mr Chris Davis who is a Member of the Australasian Institute of Mining and Metallurgy and a full-time employee of Alkane Resources Limited. Mr Davis has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the JORC Code and as a Qualified Person underNI 43-101. Mr Davis consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

The information in this announcement that relates to previously reported exploration results, mineral resources and ore reserves is extracted from the Company’s ASX announcements noted in the text of the announcement and available to view on the Company’s website. The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcements and that the form and context in which the Competent Person’s findings are presented have not been materially altered.

Cautionary Note Regarding Forward-Looking Information and Statements

This announcement contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation and may include future-oriented financial information or financial outlook information (collectively Forward-Looking Information). Actual results and outcomes may vary materially from the amounts set out in any Forward-Looking Information. As well, Forward-Looking Information may relate to: future outlook and anticipated events; expectations regarding exploration potential; production capabilities and future financial or operating performance, including AISC, investment returns, margins and share price performance; production and cost guidance and the timing thereof; issuing updated resources and reserves estimate and the timing thereof; the potential of Alkane to meet industry targets, public profile and expectations; and future plans, projections, objectives, estimates and forecasts and the timing related thereto.

Forward-Looking Information is generally identified by the use of words like "will", "create", ", "create", "enhance", "improve", "potential", "expect", "upside", "growth" and similar expressions and phrases or statements that certain actions, events or results "may", "could", or "should", or the negative connotation of such terms, are intended to identify Forward-Looking Information.

Although Alkane believes that the expectations reflected in the Forward-Looking Information are reasonable, undue reliance should not be placed on Forward-Looking Information since no assurance can be provided that such expectations will prove to be correct. Forward-Looking Information is based on information available at the time those statements are made and/or good faith belief of the officers and directors of Alkane as of that time with respect to future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or suggested by the Forward-Looking Information. Forward-Looking Information involves numerous risks and uncertainties. Such factors include, without limitation: risks relating to changes in the gold and antimony price.

Forward-Looking Information is designed to help readers understand Alkane’s views as of that time with respect to future events and speak only as of the date they are made. Except as required by applicable law, Alkane assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the Forward-looking Information. If Alkane updates any one or more forward-looking statements, no inference should be drawn that the company will make additional updates with respect to those or other Forward-looking Information. All Forward-Looking Information contained in this announcement is expressly qualified in its entirety by this cautionary statement.

Disclaimer

Alkane has prepared this announcement based on information available to it. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions or conclusions contained in this announcement. To the maximum extent permitted by law, none of Alkane, its directors, officers, employees, associates, advisers and agents, nor any other person accepts any liability, including, without limitation, any liability arising from fault or negligence on the part of any of them or any other person, for any loss arising from the use of this announcement or its contents or otherwise arising in connection with it.

This announcement is not an offer, invitation, solicitation, or other recommendation with respect to the subscription for, purchase or sale of any security, and neither this announcement nor anything in it shall form the basis of any contract or commitment whatsoever.

Non-IFRS Performance Measures

This announcement contains references to all-in sustaining costs which is a non-IFRS measure and does not have a standardised meaning under IFRS. Therefore, this measure may not be comparable to similar measures presented by other companies. All-in sustaining costs include total cash operating costs, sustaining mining capital, royalty expense and accretion of reclamation provision. Sustaining capital reflects the capital required to maintain a site’s current level of operations. All-in sustaining cost per ounce of gold equivalent in a period equals the all-in sustaining cost divided by the equivalent gold ounces produced in the period.

CONTACT: NIC EARNER, MANAGING DIRECTOR & CEO, ALKANE RESOURCES LTD, TEL +61 8 9227 5677

INVESTORS & MEDIA: NATALIE CHAPMAN, CORPORATE COMMUNICATIONS MANAGER, TEL + 61 418 642 556

1 Gold equivalent ounces calculated by multiplying quantities of gold and antimony in period by respective average market price of commodities in period, adding the two amounts to get ‘total contained value based on market price’ and dividing that total contained value by the average market price of gold in period. I.e., AuEq = ((Au Produced x Au $/oz) + (Sb Produced pre-payability x 70% payability x Sb $/t)) / (Au $/oz). The average market prices for the December quarter were A$6,299/oz Au (being the average of the daily PM price, sourced from www.lbma.org.uk) and A$30,245/t Sb (being the average Shanghai Metal Market Price sourced from www.metal.com).

2 AISC is a non-IFRS measure and does not have a standardised meaning under IFRS and might not be comparable to similar financial measures disclosed by other companies. Refer to "Non-IFRS Performance Measures" at the end of this announcement.

3 Refer to ALK Announcement dated 9 September 2025 titled ‘Alkane Announces Financial Year 2026 Guidance’ for calculation of gold equivalent ounces and definition of Group Guidance. Production guidance on a statutory reported basis (‘Attributable Guidance’) is 155 – 168koz AuEq for FY2026.

4 Refer to ALK Announcement dated 19 December 2025 titled ‘Alkane Doubles the Tested Depth Extent of the Storheden Deposit at Björkdal.”

5 Refer to ALK Announcement dated 3 November 2025 titled ‘Tomingley Drilling Discovers New Mineralisation at McLeans.”

6 As the merger with Mandalay Resources completed on 5 August 2025, Alkane’s statutory reported production for FY2026 reflects production from Costerfield and Björkdal only from that date. Full year production and costs can be found at the end of this report.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e5e8ab27-bf60-4cbb-b5b4-6e65d7a8569f

https://www.globenewswire.com/NewsRoom/AttachmentNg/739c87e5-c056-4210-a7f6-db05531e29a9

https://www.globenewswire.com/NewsRoom/AttachmentNg/eda3af68-7336-4e6a-849e-d499e82b2918

https://www.globenewswire.com/NewsRoom/AttachmentNg/08ab5df4-946a-4fbe-9dce-3850d367b933

https://www.globenewswire.com/NewsRoom/AttachmentNg/8e11ff91-415d-49ff-8a1f-0264031ddd4f

https://www.globenewswire.com/NewsRoom/AttachmentNg/613e7d73-9374-45de-81e3-69f554e280df

https://www.globenewswire.com/NewsRoom/AttachmentNg/a3317f64-51a7-4bdf-b60c-de2a34c89484

https://www.globenewswire.com/NewsRoom/AttachmentNg/d0c7ae13-a239-4052-851f-6017b4f477b3

Subscribe to releases from Globenewswire

Subscribe to all the latest releases from Globenewswire by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Globenewswire

Alkane Resources Limited29.1.2026 23:47:13 CET | Press release

Proposed Investment and Earn-in with Nagambie Resources

RECORDATI29.1.2026 23:19:55 CET | Press release

RECORDATI ANNOUNCES STRATEGIC COLLABORATION WITH MODERNA TO DEVELOP AND COMMERCIALIZE WORLDWIDE mRNA 3927 FOR THE TREATMENT OF PROPIONIC ACIDEMIA

Zoom Communications, Inc.29.1.2026 22:05:00 CET | Press release

Zoom to Release Financial Results for the Fourth Quarter and Full Fiscal Year 2026

TekniPlex29.1.2026 21:36:47 CET | Press release

TekniPlex to Showcase Next-Generation Sealing Innovations at Paris Packing Week 2026

DICTADOR EUROPE Sp. z o.o.29.1.2026 19:39:06 CET | Press release

Dictador Names Will Smith as Global Artistic Director, Marking a Bold New Chapter for the Luxury Rum House

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom