MicroVision Announces Fourth Quarter and Full Year 2024 Results

REDMOND, WA / ACCESS Newswire / March 26, 2025 / MicroVision, Inc. (NASDAQ:MVIS), a technology pioneer delivering advanced perception solutions in autonomy and mobility, today announced its fourth quarter 2024 results.

Key Business Highlights

Significant momentum toward near-term revenue opportunities from multiple leading industrial companies in the autonomous mobile robot (AMR) and automated guided vehicle (AGV) sector.

Actively engaged with top-tier global automotive OEMs, with seven high-volume RFQs for passenger vehicles and custom development opportunities.

Secured production commitment to ensure continuous and uninterrupted supply of sensors and integrated software to meet anticipated volume demand.

Deepened executive leadership expertise with the hiring of Glen DeVos, former CTO of Aptiv, to lead the enhancement of our product portfolio and expansion of our customer solutions.

Streamlined cost structure in 2024, resulting in sequential improvement in cash burn.

Secured a $75 million convertible note facility with an institutional investor, plus raised an additional $8 million in the first quarter of 2025 through an equity sale to the same investor.

"MicroVision is well positioned to secure revenue opportunities for 2025, primarily from three verticals: industrial, automotive, and defense," said Sumit Sharma, MicroVision's Chief Executive Officer. "Our unique value proposition continues to be our integrated perception software with our MAVIN and MOVIA sensors. We continue to offer compelling solutions to industrial customers and automotive OEMs at attractive price points."

Sharma continued, "With a well-capitalized balance sheet including $75 million in cash and cash equivalents and access to additional capital of up to $161 million subject to certain conditions, we believe we are in a strong position to support customer demand and commit to high-volume deliveries. Last year, we secured a production commitment with ZF to enable us to fulfill demand in the range of $30-$50 million over the next 12-18 months, which we expect to be driven primarily by customers in the AMR/AGV vertical. With a strong balance sheet and improved cost structure, we are offering comprehensive solutions at competitive prices to solidify our position in the market. We expect to continue scaling resources, both internally and with third party vendors and suppliers, as we remain engaged with automotive OEMs and responsive to their evolving timelines."

Key Financial Highlights for Q4 2024 and Full Year 2024

Revenue for the fourth quarter of 2024 was $1.7 million, compared to $5.1 million for the fourth quarter of 2023. Excluding the one-time revenue from Microsoft of $4.6 million in Q4 2023, the revenue growth in Q4 2024 was driven by demand primarily from industrial customers. Q4 revenue was short of our expectations as a customer was delayed into 2025.

Net loss for the fourth quarter of 2024 was $31.2 million, or $0.14 per share, which includes $2.0 million of non-cash, share-based compensation expense and $13.2 million of the new convertible note-related expense, compared to a net loss of $19.7 million, or $0.10 per share, which includes $4.6 million of non-cash, share-based compensation expense, for the fourth quarter of 2023.

Adjusted EBITDA for the fourth quarter of 2024 was a $13.2 million loss, compared to a $13.6 million loss for the fourth quarter of 2023.

Cash used in operations in the fourth quarter of 2024 was $15.0 million, compared to cash used in operations in the fourth quarter of 2023 of $16.6 million.

The Company ended the fourth quarter of 2024 with $74.7 million in cash and cash equivalents, including investment securities, compared to $73.8 million at December 31, 2023.

Subsequent to the fourth quarter, the Company bolstered its financial position by entering into an agreement to raise up to $17 million in new equity capital and reducing future cash obligations stemming from its $75 million senior secured convertible note facility with High Trail Capital. To date, $12.25 million of the convertible note has been converted into common stock, thereby reducing the Company's obligations under the note by over 27%. With this new equity investment, the Company has access to $161 million of capital, subject to certain market conditions, including $17 million in new equity capital, $114 million under its existing ATM, or at-the-market, facility and $30 million from the remaining commitment pursuant to the convertible note facility.

Conference Call and Webcast: Q4 2024 Results

MicroVision will host a conference call and webcast, consisting of prepared remarks by management, a slide presentation, and a question-and-answer session at 1:30 PM PT/4:30 PM ET on Wednesday, March 26, 2025 to discuss the financial results and provide a business update. Analysts and investors may pose questions to management during the live webcast on March 26, 2025.

The live webcast and slide presentation can be accessed on the Company's Investor Relations website under the Events tab HERE. The webcast will be archived on the website for future viewing.

About MicroVision

MicroVision drives global adoption of innovative perception solutions to make mobility and autonomy safer. Fueled by engineering excellence in Redmond, Washington and Hamburg, Germany, MicroVision develops and supplies an integrated solution built on its perception software stack, incorporating application software and processing data from differentiated sensor systems. MicroVision's proprietary technology solutions deliver enhanced safety for a variety of industrial applications, including robotics, automated warehouse, and agriculture, and the automotive industry accelerating advanced driver-assistance systems (ADAS) and autonomous driving, as well as for military applications. With deep roots in MEMS-based laser beam scanning technology that integrates MEMS, lasers, optics, hardware, algorithms and machine learning software, MicroVision has the expertise to deliver safe mobility at the speed of life.

For more information, visit the Company's website at www.microvision.com, on Facebook at www.facebook.com/microvisioninc, and LinkedIn at https://www.linkedin.com/company/microvision/.

MicroVision, MAVIN, MOSAIK, and MOVIA are trademarks of MicroVision, Inc. in the United States and other countries. All other trademarks are the properties of their respective owners.

Non-GAAP information

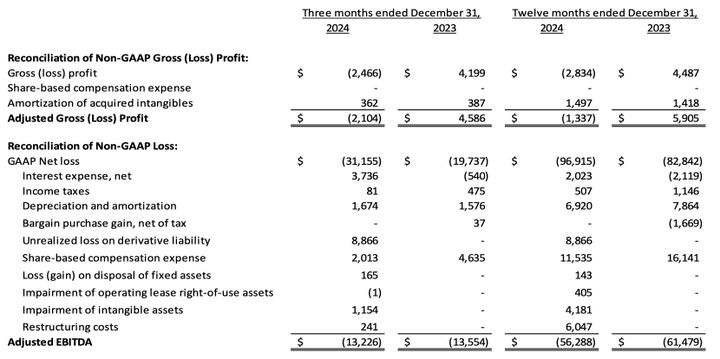

To supplement MicroVision's condensed financial statements presented in accordance with GAAP, the Company presents investors with the non-GAAP financial measures "adjusted EBITDA" and "adjusted Gross Profit." Adjusted EBITDA consists of GAAP net income (loss) excluding the impact of the following: interest income and interest expense; income tax expense; depreciation and amortization; bargain purchase gain; gains and losses on derivatives and disposals; share-based compensation; impairment charges; and restructuring costs. Adjusted Gross Profit is calculated as GAAP gross profit before share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

MicroVision believes that the presentation of adjusted EBITDA and adjusted Gross Profit provides important supplemental information to management and investors regarding financial and business trends, provides consistency and comparability with MicroVision's past financial reports, and facilitates comparisons with other companies in the Company's industry, many of which use similar non-GAAP financial measures to supplement their GAAP results. Internally, management uses these non-GAAP measures when evaluating operating performance because the exclusion of the items described above provides an additional useful measure of the Company's operating results and facilitates comparisons of the Company's core operating performance against prior periods and its business objectives. Externally, the Company believes that adjusted EBITDA and adjusted Gross Profit are useful to investors in their assessment of MicroVision's operating performance and the valuation of the Company.

Adjusted EBITDA and adjusted Gross Profit are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the costs associated with the operations of MicroVision's business as determined in accordance with GAAP. The Company expects to continue to incur expenses similar to the non-GAAP adjustments described above, and exclusion of these items from its non-GAAP financial measures should not be construed as an inference that these costs are unusual or infrequent.

The Company compensates for limitations of the adjusted EBITDA measure by prominently disclosing GAAP net income (loss), which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation from GAAP net income (loss) to adjusted EBITDA.

Similarly for adjusted Gross Profit, the Company compensates for limitations of the measure by prominently disclosing GAAP gross profit which is the difference between Revenue and Cost of revenue, which the Company believes is the most directly comparable GAAP measure, and providing investors with a reconciliation by backing out share-based compensation expense and the amortization of acquired intangibles included in cost of revenue.

Forward-Looking Statements

Certain statements contained in this release, including customer engagement and the likelihood of success; opportunities for revenue and cash; expense reduction; market position; product portfolio; product and manufacturing capabilities; access to capital and capital-raising opportunities; and expected revenue, expenses and cash usage are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those projected in such forward-looking statements include the risk its ability to operate with limited cash or to raise additional capital when needed; market acceptance of its technologies and products or for products incorporating its technologies; the failure of its commercial partners to perform as expected under its agreements; its financial and technical resources relative to those of its competitors; its ability to keep up with rapid technological change; government regulation of its technologies; its ability to enforce its intellectual property rights and protect its proprietary technologies; the ability to obtain customers and develop partnership opportunities; the timing of commercial product launches and delays in product development; the ability to achieve key technical milestones in key products; dependence on third parties to develop, manufacture, sell and market its products; potential product liability claims; its ability to maintain its listing on The Nasdaq Stock Market, and other risk factors identified from time to time in the Company's SEC reports, including the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other reports filed with the SEC. These factors are not intended to represent a complete list of the general or specific factors that may affect the Company. It should be recognized that other factors, including general economic factors and business strategies, may be significant, now or in the future, and the factors set forth in this release may affect the Company to a greater extent than indicated. Except as expressly required by federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changes in circumstances or any other reason.

Investor Relations Contact

Jeff Christensen

Darrow Associates Investor Relations

MVIS@darrowir.com

Media Contact

MicroVision, Inc.

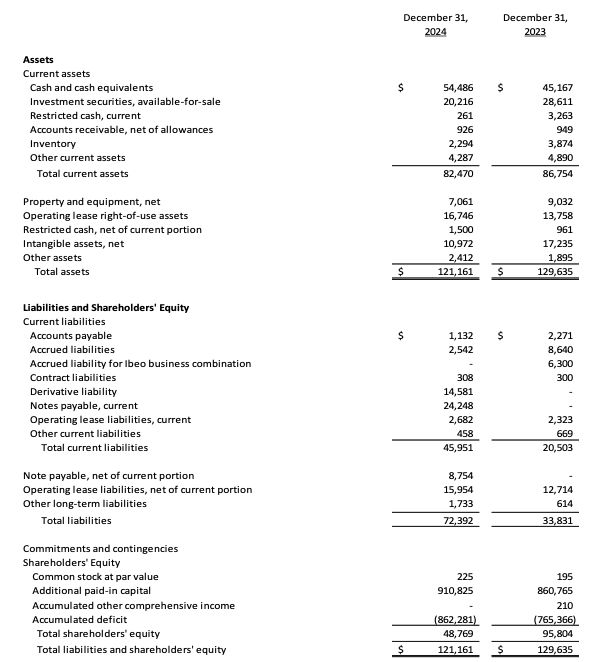

Consolidated Balance Sheets

(In thousands)

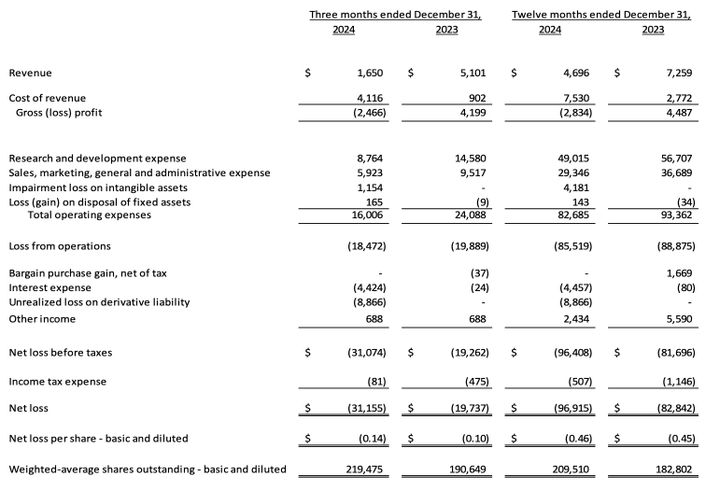

MicroVision, Inc.

Consolidated Statements of Operations

(In thousands, except per share data)

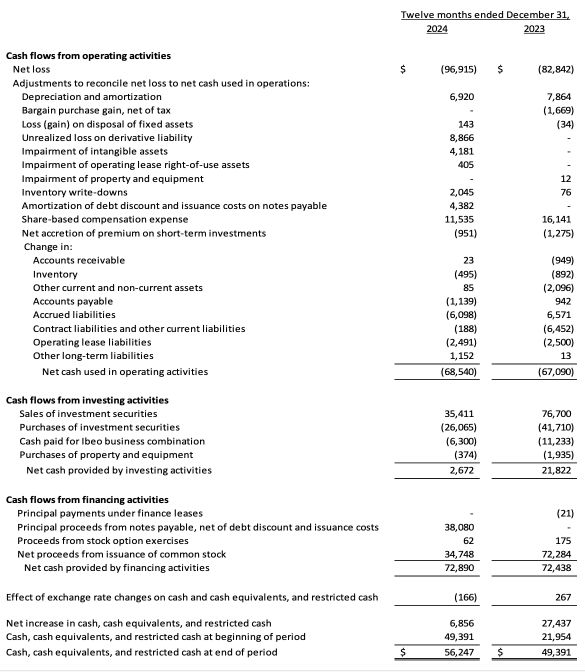

MicroVision, Inc.

Consolidated Statements of Cash Flows

(In thousands)

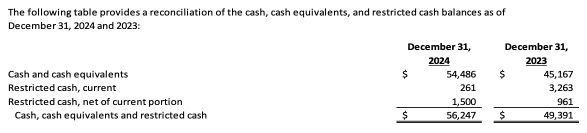

MicroVision, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(In thousands)

SOURCE: MicroVision, Inc.

View the original press release on ACCESS Newswire

MicroVision, Inc

Subscribe to releases from ACCESS Newswire

Subscribe to all the latest releases from ACCESS Newswire by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from ACCESS Newswire

Honoring Innovation, Excellence, and Leadership at the 2025 APEX/IFSA Awards: APEX Honored Aviation's Industry Trailblazers and Visionaries12.9.2025 08:00:00 CEST | Press release

WASHINGTON, D.C. / ACCESS Newswire / September 12, 2025 / Airlines and suppliers were celebrated for their meaningful advancements in passenger experience at the prestigious APEX/IFSA Awards Ceremony in Long Beach, California. Hosted by the APEX (Airline Passenger Experience Association) and the IFSA (International Flight Services Association) during the APEX/IFSA Global EXPO, the ceremony is regarded as the industry's premier awards event, recognizing innovation, dedication, and leadership that set new standards for excellence across the skies.APEX IFSA "What sets the APEX/IFSA Awards apart comes from how our awards program moves beyond recognition; it actively drives excellence across our entire industry," APEX/IFSA Group CEO Dr. Joe Leader stated. "Unlike other award platforms, these honors reflect both the voices of millions of global passengers and the rigorous assessments of independent experts. This powerful combination establishes the APEX/IFSA Awards as the most trusted and im

Among Migrating Nurses, Survey Shows High Satisfaction Rates for Those Who Use a Certified Ethical Recruiter11.9.2025 21:30:00 CEST | Press release

PHILADELPHIA, PA / ACCESS Newswire / September 11, 2025 / In a new survey, foreign-educated nurses and other healthcare professionals who migrate to work in the United States continue to give high marks to recruitment firms that are certified by the Alliance for Ethical International Recruitment Practices.TruMerit Ethical International Recruitment Report How certification helps safeguard the rights of foreign-educated health professionals. The Alliance, a division of TruMerit (formerly CGFNS International), in 2024 surveyed more than 8,000 foreign-educated health professionals who had used one of its 19 Certified Ethical Recruiters (CERs). Ninety percent of respondents indicated they had an overall positive experience with their recruiter, with 55% reporting it was very positive. As the survey report shows, the high satisfaction rate essentially held steady from 2023 despite persisting delays and increased costs in the U.S. immigration process. In an earlier TruMerit/CGFNS survey of it

Raven Resources Reports Strong First-Year Results Following Grove Electric Acquisition11.9.2025 15:00:00 CEST | Press release

GROVE, OKLAHOMA / ACCESS Newswire / September 11, 2025 / Raven Resources today announced robust first-year financial results following its acquisition of Grove Electric, a leading electrical contracting and services company based in Grove, Oklahoma. For the fiscal year ending August 31, 2025, Grove Electric achieved a 30% increase in revenues compared to the prior year. The September 2024 acquisition was a strategic move to expand Raven Resources' portfolio of service-oriented businesses in fast-growing regional markets. The strong results highlight both the successful integration of Grove Electric and the sustained demand for high-quality electrical contracting services across Northeast Oklahoma. "We are extremely pleased with Grove Electric's first year under Raven Resources," said Paul Scribner, CEO of Raven Resources. "The growth we've seen is a testament to the dedication of Grove Electric's team and the company's reputation for reliable, professional service. This performance rei

Richmond Terrace Capital Secures €900 Million from European Pension Leaders11.9.2025 12:30:00 CEST | Press release

CITY OF LONDON, GB / ACCESS Newswire / September 11, 2025 / Richmond Terrace Capital, a leading London-based investment management company, is pleased to announce that a consortium of leading European pension funds has awarded the firm new discretionary mandates totaling approximately €900 million, with an additional €1.5 billion in commitments scheduled for early 2026. Through these mandates, Richmond Terrace Capital will provide end-to-end portfolio management and strategic investment guidance, designed to deliver consistent value in line with each client's investment objectives. Record Momentum Powered by Strategic Growth This landmark development caps one of Richmond Terrace Capital's strongest years to date, driven by the exceptional performance of its flagship funds and private equity platforms. Investment success has been particularly evident in transformative sectors such as Commercial Space Ventures, Advanced Connectivity Infrastructure, and Artificial Intelligence application

Dalet Unveils Agentic AI Media Workflows at IBC202511.9.2025 10:50:00 CEST | Press release

New Dalet intelligent interface simplifies even the most complex production and media supply chain operations, enabling users to streamline workflows through a familiar, natural language user experience. NEW YORK, NY / ACCESS Newswire / September 11, 2025 / Dalet today announced a transformative leap forward for media operations: Agentic Artificial Intelligence (AI) that unifies the Dalet ecosystem under one natural language conversational‑style user experience. Far more than an AI chatbot, Dalia is an intelligent layer embedded across Dalet Flex , Dalet Pyramid , Dalet InStream , Dalet Brio , and Dalet Amberfin , featuring a family of media-aware agents that act as assistants to facilitate complex workflows across ingest, production, rights management, distribution and archive. By combining the simple-to-use characteristics of SaaS point solutions with the enterprise strength of Dalet's architecture and workflow expertise, the company has made a game-changing move forward, giving cust

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom