Robex Resources Inc.

Updated Kiniero Feasibility Study Achieves Increase +46% in Gold Reserves and +89% NPV to US$322M

Updated Kiniero Feasibility Study Achieves Increase +46% in Gold Reserves and +89% NPV to US$322M

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE U.S.

HIGHLIGHTS:

- Increased Reserves Life Of Mine (“LoM”): Mineral Reserves increased by 442,000oz or 46% to 1.41 million ounces from Kiniero's 2023 Feasibility Study (“2023 FS”);

- Potential to grow Mineral Reserves: Kiniero has Indicated Mineral Resources (inclusive of Mineral Reserves) at 2.2Moz @ 0.96g/t Au, plus Inferred Mineral Resources of 1.53Moz @ 1.05g/t Au (effective September 1 2024); More than 25,000 metres of drilling completed since the database cut off. An updated Reserve Statement to include this drill data is scheduled to be released in Q2 2025;

- Improved economics: The updated study demonstrates increase in pre-tax Net Present Value at a discount rate of 5% (NPV5%)

- Base Case (Gold Price US$1,800/oz)

- Pre-tax NPV: US$480M,

- Pre-tax IRR: 47%.

- Post-tax NPV: US$322M,

- Post-tax IRR: 36%.

- Consensus Case (Gold Price: US$2,330/oz): Pre-tax NPV of US$940M, Pre-tax IRR of 79%, Post-tax NPV of US$647M, Post-tax IRR of 61%.

- Stronger economic metrics compared to the 2023 FS (US$1650/oz gold price), which demonstrated pre-tax NPV5% of US$251M and IRR of 42%; post-tax NPV5% of US$170M with IRR of 31%;

- Base Case (Gold Price US$1,800/oz)

- Average annual gold production: Kiniero expected to produce 139,000 ounces gold per year over 9-year mine life with average production of 154,000oz over the first six years;

- Costs in line with Budget: LoM All-In Sustaining Costs (“AISC”) of US$1,066 /oz, increasing by 9% from 2023 FS (US$980/oz);

- Improved strip ratio: LoM Strip Ratio of 2.0:1, from 2.8:1 in the 2023 FS; helping to lower mining costs.

QUÉBEC CITY, Jan. 14, 2025 (GLOBE NEWSWIRE) -- Robex Resources Inc. (“Robex” or the “Company”) (TSXV: RBX) is pleased to announce the results of an updated feasibility study (the “FS”, “Feasibility Study” or “Study” or “2024FS”) for Its Kiniero Gold Project (the “Kiniero Gold Project”, or the “Project”) in Conakry, Guinea.

Using a base case gold price of US$1800/oz, the Study demonstrates Kiniero’s ability to produce an average of 139,000oz of gold per year at a US$1,066/oz AISC over the 9-year LoM, with an average gold production of 154,000oz per year in the first six years. Mine plan optimization efforts prioritized a stable, long mine life, rather than peak upfront production.

Robex is on track to pour first gold at Kiniero in Q4 2025, with construction already underway on the 5 million tonne per annum (Mtpa) processing plant, with a 6Mtpa capacity on early year high oxide blends and associated infrastructure. The company will continue its near-mine exploration efforts to extend the LoM rapidly in conjunction with the annual production. Robex is still in advance discussions with lenders for a debt facility which is expected to close in Q1 2025.

Robex Managing Director Matthew Wilcox commented: “Updating the feasibility study for our Kiniero Gold Project in Guinea is a major milestone in our journey towards project development, as the FS optimizations and updated Mineral Resource Estimate have delivered increased Mineral Reserves and stronger economics for the project. The base case gold price of US$1,800/oz post-tax NPV now stands at US$322 million with an IRR of 36%, which have both improved +89% on the 2023 FS results within a very short period. At consensus price of US$2,330/oz the post tax NPV5% stands at US$647m or A$1bn.

In addition, with the high prospectivity of our property we will be growing the current production and LoM very rapidly. We expect to average gold production of nearly 140,000oz of gold a year over the project's 9-year life, with early gold production of 153,000oz a year over the first six years ideally timed to benefit from the current high gold price environment.

An additional 25,000m of drilling has been completed and it will be part of an updated MRE to potentially further increase the resources and reserves which should be released in Q2, 2025.

With construction now progressing well at Kiniero we issue market updates frequently; we look forward to our ASX listing in coming months and becoming West Africa's newest gold producer before the end of 2025.”

The FS was prepared in accordance with Canadian Securities Administrators’ National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”).

The independent NI 43-101 technical report supporting the Kiniero Gold Project Feasibility Study Update will be published on SEDAR at www.sedar.com within the next 45 days.

The FS was prepared in accordance with Canadian Securities Administrators’ National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”).

The independent NI 43-101 technical report supporting the Kiniero Gold Project Feasibility Study Update will be published on SEDAR at www.sedar.com within the next 45 days.

Table 1 compares the results of the updates study with the 2023 FS.

Table 1: 2024 Improvements on from 2023 FS results

| Item | Units | 2023 FS @ US$1,650/oz gold price | 2024 FS @ US$1,800/oz gold price | Variation | |

| Probable Mineral Reserves (incl. legacy stockpiles) | Moz | 0.968 | 1.41 | +46% | |

| LoM | Year | 9.5 | 9 | -5.2% | |

| Average annual production LoM | koz | 90 | 139 | +54% | |

| Pre-production Capital | US$M | 160 | 243 | +52% | |

| LoM AISC | US$/oz | 980 | 1,023 | +4% | |

| Pre-tax NPV5%* | US$M | 251 | 480 | +91% | |

| Pre-tax IRR | % | 42% | 47% | +12% | |

| Post-tax NPV5% | US$M | 170 | 322 | +89% | |

| Post-tax IRR | % | 31% | 36% | +16% | |

*NPV in the 2023 FS calculated as of 1st of July 2023 while the NPV in 2024 FS estimated as of 1st of September 2024

Update on Construction Activities at Kiniero

The Kiniero Gold Project construction has commenced with civil (concrete) works on the process plant, the erection of the Carbon-in Leach/Gravity (“CIL”) tanks, and the clearing of the tailings dam basin.

The Project engineering is approximately 75% complete, all long lead items have been purchased, and 95% of other equipment has been tendered.

The Project is currently on track to pour first gold by the end of calendar year 2025.

Highlights of Updated Feasibility Study

Ore mined from the Kiniero deposit is expected to be processed through a standard 5Mtpa nominal capacity CIL plant. The mine is expected to be an open pit using conventional mining methods.

Table 2: Kiniero 2024 FS Highlights

| Units | Value | |

| Plant, size and CAPEX | ||

| Plant capacity (@35% Fresh) | Mtpa | 5 |

| Plant capacity (@18% Fresh) | Mtpa | 6 |

| Upfront capital from January 1, 2023 | US$M | 243 |

| Mineral Reserves and Resources (incl. legacy stockpiles) | ||

| Probable Mineral Reserves | Moz | 1.41 |

| Indicated Resources (incl. Reserves) | Moz | 2.203 |

| Inferred Resources | Moz | 1.52 |

| Mining Operations | ||

| LoM total tonnes mined | Mt | 119 |

| LoM waste tonnes mined | Mt | 80 |

| LoM ore tonnes mined ex pit | Mt | 39 |

| Average grade mined | g/t Au | 1.04 |

| LoM strip ratio | W:O | 2.0 |

| Processing Operations | ||

| LoM tonnage processed | Mt | 45 |

| Average grade processed | g/t Au | 0.97 |

| Average recovery LoM | % | 86.2% |

| Production and Costs Summary | ||

| LoM production | koz/Au | 1,215 |

| Average first three years of production pa | koz/Au | 153 |

| Average LoM production pa | koz/Au | 139 |

| AISC | US$/oz | 1,066 |

Table 3: Summary of NPV, IRR and payback at $1800/oz and consensus forward gold price

| Units | US$1,800/oz (Reserve Gold Price) | US$ ~2,330/oz (2024 Consensus gold price*) | |

| Pre-tax returns | |||

| NPV5% | US$M | 480 | 940 |

| IRR | % | 47% | 79% |

| Payback period | year | 2.1 | 1.3 |

| Post-tax returns | |||

| NPV5% | US$M | 322 | 647 |

| IRR | % | 36% | 61% |

| Payback period | year | 2.6 | 1.6 |

*the S&P consensus long term gold price at end of October 2024, ranging between US$2431/oz and US$2,320/oz

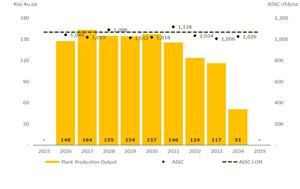

As shown in Figure 1 below, the Study demonstrates Kiniero’s ability to deliver an average of 139koz of gold per annum at an AISC of US$1,066/oz over the LoM at consensus gold price, as mine plan optimization efforts prioritized a stable, long mine life, rather than peak upfront production. Over the coming years, Robex intends to continue its exploration efforts to continue to extend the LoM and increase annual production.

Figure 1: Gold Production and AISC Summary across the LoM

FEASIBILITY STUDY DETAILS

Overview

The Project is located in eastern Guinea in the Kouroussa Prefecture. It is situated 27km southeast of the town of Kouroussa and 546km from Conakry, the capital of Guinea (Figure 2: Regional Locality of the Kiniero Gold Project and Regional Infrastructure of Guinea).

The Kiniero Gold Project is a 470.48km² exploitation and exploration land package that consists of the adjoining Kiniero exploitation Licence Area and Mansounia exploitation Licence Area. The Kiniero Gold Project is one of the largest gold licences in Guinea.

Figure 2: Regional Locality of the Kiniero Gold Project and Regional Infrastructure of Guinea

Kiniero gold deposits, located in the prolific gold-producing Siguiri Basin, were discovered in the early 1900s and were subsequently explored until 2002 when gold production began under the ownership of SEMAFO Inc and its subsidiary SEMAFO Guinée SA.

The historical Kiniero gold mine comprised an open pit mining operation that produced 418,000 ounces of gold during its 12-year operational history. The mine was placed on care and maintenance in early 2014.

Given the strong exploration potential, a combination of near plant brownfields infill and known extension, as well as greenfield large-scale targets, Robex is targeting (i) the discovery of Mineral Resources across the Kiniero exploration permit area over the next few years, and (ii) the conversion of Mineral Resources into Mineral Reserves.

An extensive drilling program is ongoing on the numerous identified deposits to increase the resource base and extend the LoM at Kiniero predominately through extending the drilling density at depth and along known strike extensions.

Since the beginning of the construction, Robex has been committed to involve village communities in the mine's development, as well as exploring sustainable power energy source to reduce and limit its environmental footprint.

Geology

The property is located within the Kiniero Gold District of the Siguiri Basin, which is situated in north-eastern Guinea, extending into central Mali. Geologically, the Siguiri Basin comprises a portion of the West Africa Birimian Greenstone Belt, including intrusive volcanics (ultramafics to intermediate) and sediments largely deposited through the period 2.13 Ga to 2.07 Ga.

The volcanic and sedimentary lithologies comprise fine-grained sedimentary rocks (shales and siltstones), with some intercalated volcanic rocks. Sandstone-greywacke tectonic corridors have been preferentially altered and locally silicified, supporting extensive brittle fracture networks. These in turn have provided host environments for ascending mineralized hydrothermal fluids.

The deposits located on the property are associated with the Proterozoic Birimian orogeny of West Africa. Most gold mineralization in the West African Craton is shear-zone-hosted and structurally controlled, with lithology having a minor, local influence. The mineralization developed in the Kiniero Gold District conforms to this general style of mineralization.

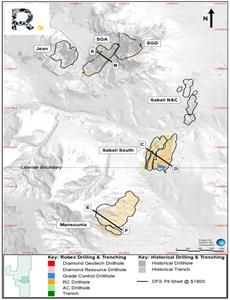

A total of 47 gold anomalies have been identified on the property, of which five clusters of deposits (Sabali, Mansounia, SGA, Jean, and Balan) have been explored sufficiently to enable the estimation of Mineral Resources.

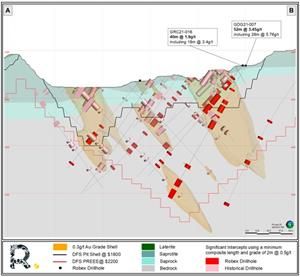

Figure 3: Location of the main Kiniero deposits and cross sections (A-B, C-D) and Figure 4: Cross sections through the SGA (A-B) Sabali South (C-D) deposits illustrate the location of the main Kiniero deposits and cross sections through the SGA and Sabali South deposits. The selected cross sections display the 0.3g/t gold grade shell, Pit and RPEE (Reasonable Prospects of Economic Extraction) Shells, significant gold intercepts (minimum of 2m @ 0.5g/t), and regolith profiles across each deposit. Section A-B, across SGA, demonstrates the deposit's significant northeast strike and depth extension. Section C-D, across Sabali South, shows the deposit's deep weathering saprolite and saprock profile in the east (beyond 100m in areas).

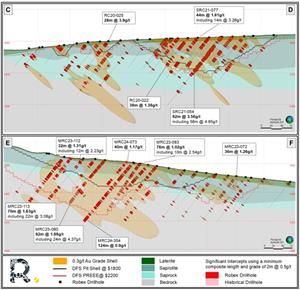

Section E-F, across Mansounia Central, shows the depth extension of the northeast strike.

Figure 3: Location of the main Kiniero deposits and cross sections (A-B, C-D, E-F)

Figure 4: Cross sections through the SGA (A-B), Sabali South (C-D) and Mansounia Central (E-F) deposit

Mineral Reserves and Resources

The January 2025 FS update is based on the updated Mineral Resources Estimate (“MRE”), as shown in Table 4 below, which has a resource-to-reserve conversion ratio for the in-situ estimate of 66%. The MRE includes the Mineral Reserves.

Table 4: Mineral Reserves and Resources Summary

| 100% basis | Tonnage (Mt) | Grade (Au g/t) | Content (koz) |

| Probable Mineral Reserves (in-situ) | 39.3 | 1.04 | 1,320 |

| Probable Mineral Reserves (Legacy Stockpiles) | 6.3 | 0.48 | 100 |

| Total Probable Mineral Reserves | 45.5 | 0.97 | 1,410 |

| Indicated Mineral Resources (in-situ) | 59.62 | 1.08 | 2,064 |

| Indicated (Legacy Stockpiles) | 11.61 | 0.37 | 139 |

| Total Indicated Mineral Resources (incl. of. Mineral Reserves) | 71.23 | 0.96 | 2,203 |

| Inferred Mineral Resources (in-situ) | 45.10 | 1.05 | 1,519 |

| Inferred (Legacy Stockpiles) | 0.19 | 1.31 | 8 |

| Total Inferred Mineral Resources | 45.29 | 1.05 | 1,527 |

Notes:

- The effective date of the Mineral Resource and Reserves is 30 November 2024.

- The date of closure for the sample database informing the in situ Mineral Resources excluding Mansounia, is 17 August 2022. The date of database closure for the Mansounia MRE is 16 October 2024.

- Cut-off grades for Mineral Resource reporting are:

- SGA, Jean and Banfara: laterite 0.3 g/t Au, saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.3 g/t Au, fresh 0.4 g/t Au.

- Sabali South: laterite 0.3 g/t Au, mottled zone/saprolite/lower saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.5 g/t Au, fresh 0.6 g/t Au.

- Sabali North and Central: laterite 0.3 g/t Au, saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.6 g/t Au, fresh 0.6 g/t Au.

- West Balan: laterite 0.3 g/t Au, saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.3 g/t Au, fresh 0.5 g/t Au.

- Mansounia Central: laterite 0.4 g/t Au, saprolite (oxide) 0.3 g/t Au, saprock (transition) 0.5 g/t Au, fresh 0.5 g/t Au.

- Stockpiles reported as Mineral Resources have been limited to those dumps which exhibit an average grade >0.3 g/t Au for the entire stockpile assuming no selectivity.

- These are based on a gold price of US$2,200/oz and costs and recoveries appropriate to each pit and type of feed.

- The QP for this MRE is Mr Ingvar Kircher.

- Mineral Resources are reported inclusive of Mineral Reserves.

- Open-pit Mineral Resources were constrained using optimum pit shells based on a gold price of US$2,200/oz.

- CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014) were used for reporting the Mineral Reserve.

- Mineral Reserve was estimated using a long-term gold price of US$1,800 per troy oz for all mining areas.

- Mineral Reserve is stated in terms of delivered tonnes and grade before process recovery.

- Mineral Reserve was defined by pit optimization and pit design and is based on variable break-even cut-offs as generated by process destination and metallurgical recoveries.

- Metal recoveries are variable, dependent on material type and mining area.

- Dilution and ore loss was applied through application of 1.0 m dilution skins to the resource model using Mineable Shape Optimizer.

- The QP responsible for this item of the Technical Report is not aware of any mining, metallurgical, infrastructure, permitting, or other relevant factors that could materially affect the Mineral Reserve estimate.

- The Mineral Resource has been compiled in accordance with the guidelines outlined in CIM Definition Standards, (2014).

- The estimates may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. Please see “Forward Looking Statements” below and the technical report for the Kiniero Gold Project that will be prepared in accordance with NI 43-101 and filed on SEDAR+ R at www.sedarplus.com within the next 45 day.

- Tonnage and grade measurements are in metric units. Contained Au is reported as troy ounces.

- Totals may not compute exactly due to rounding.

Exploration

The date of closure for the sample database informing the in situ Mineral Resources is 16 October 2024 for Mansounia, 17 August 2022 for all other Kiniero deposit areas and 12 November 2022 for the stockpile Mineral Resources.

Additional drilling that has been completed has not been included in this update of the resources and reserves, due to time constraints, is shown in Table 5.

Table 5 - Further drilling completed since database cut off date

| Deposit | No. Drillholes | Metres* |

| SGA | 56 | 8,123 |

| Jean | 14 | 2,165 |

| GOB D & NEGD | 38 | 6,499 |

| Sabali North | 2 | 240 |

| Sabali Central | 3 | 370 |

| Sabali South | 13 | 2,364 |

| Mankan | 43 | 5,633 |

| Total | 169 | 25,394 |

*These numbers are a combination of both reverse circulation and diamond drilling metres

Brownfields exploration will consist of trenching and drilling at and around the near-mine deposits. Drilling will be a combination of diamond and Reverse Circulation (“RC”) drilling and the purpose is twofold, namely Resource addition and Resource to Reserve conversion. Drilling will focus on four deposits: SGA, NEGD, Sabali South and Mansounia Central. SGA, NEGD and Sabali South will comprise Resource addition drilling by strike and depth extension, as well as Reserve conversion drilling.

A planned total of approximately 10,000m of diamond and 50,000m of RC drilling is planned for 2025 across various deposits. However, the drilling program will be an iterative process based on the ongoing results and the impact thereof. As a result, the plan may be changed and adapted to any changes in strategy.

Mining Operations

Mining at Kiniero is expected to be undertaken by conventional owner-operated truck and excavator open-pit mining in the SGA, Jean, SGD, Sabali South, Mansounia and Sabali North and Central pits using Komatsu PC1250-sized excavators mining on 5m benches and 2.5m flitches loading 40-tonne Komatsu HM400 haul trucks.

Mining in upper oxide layers will be free-dig with drill-and-blast required in areas that mine through the transitional material into fresh rock. The free-dig nature of the oxide zones has been confirmed by extensive previous mining at the site. Drill-and-blast will be required for approximately 30% of the oxide material, 100% of the laterite, 100% of the transitional, and 100% of the fresh.

Ore will be categorized by material and grade through in-pit grade control and will be hauled to the mine ore pad (“MOP”). Waste will be hauled to the nearest available waste dump by the Komatsu HM400 fleet.

Historic mining in Jean, SGA, and SGD has resulted in pit lakes that require dewatering and clean-up before mining.

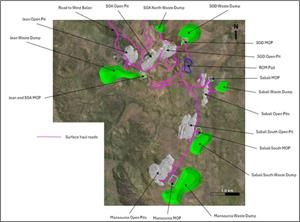

The key mining infrastructure including pits, waste dumps, stockpiles, and haulage roads is shown in Figure 5.

Figure 5: Key Mining Infrastructure Layout

Processing Operations

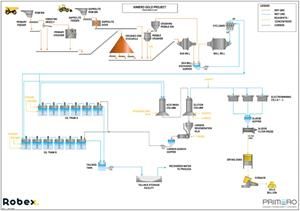

Primero Pty Ltd. (“Primero”) was commissioned by Robex to undertake the detailed re-design of the new processing plant to increase its capacity from 3Mtpa to expected throughput of 6Mtpa at 18% fresh in ore feed. The process plant design is based on a metallurgical flowsheet developed for flexible operation between the various types of ore while maintaining the throughput and gold recovery. Ore will be processed on-site, at a centrally located processing facility near the mining areas. The gold will be recovered in a beneficiation plant that has been designed to process a blend of oxide, laterite, transition, and fresh ores from various ore deposits.

Oxide and upper transition ores (soft) require less comminution energy than laterite and fresh ore (hard). However, they present other challenges in handling due to the sticky nature of oxide ore types, justifying dedicated crushing devices for soft and hard ores. The process plant design has been based on a nominal capacity of 5.0 Mtpa with 35% fresh in mill feed to 6.0 Mtpa with 18% fresh ore in feed. The flowsheet (Figure 6) includes two crushing circuits, semi-autogenous, ball grinding, and pebble crushing milling (SABC), dual CIL circuits, split Anglo-American Research Laboratories (“AARL”) elution, gold electrowinning, and carbon regeneration that are well proven in the industry.

Figure 6: Process plant simplified block flow diagram

Infrastructure

The Project benefits from good infrastructure close to the site, and a limited relocation requirement as there are no villages on the site. Existing mining infrastructure will be refurbished with minimal additional infrastructure required.

In addition, early works have focused on advancing the site infrastructure to facilitate a smooth transition into construction. Site roads to the mine from the national road network, mine perimeter fence, and the earthworks for the construction camp have already been completed as part of the early works, incurred during 2024.

New infrastructure will be added to support mining, processing and waste management on the mining license including power transmission line, diesel generators, and additional site facilities and accommodation for staff.

Power

Due to the Project location, access to the Guinea national grid is not available, thus an on-site power generation solution is required. A Heavy Fuel Oil (“HFO”)-solar and battery storage hybrid power plant is proposed for the Project, consisting of HFO generators with a capacity of approximately 28 MW, a solar photo-voltaic (“PV”) plant with total capacity of approximately 21 MWp/ 16MW AC and the battery energy storage system (“BESS”) with a capacity of 5.2 MWh with 4 MW usable capacity and 4 MW power conversion system.

Water

Water for operations will be sourced from the existing raw water catchment dam (rainwater runoff collection), dewatering of historical pits, and boreholes. Potable water will be required for the mine site and both accommodation camps during operations and construction. Currently the Main Camp has borehole water supply available and at the Staff Camp, water will be obtained from the Niandan River.

Process water will be primarily sourced from recirculated tailings storage facility (“TSF”) water. It is continuously recirculated from the TSF, to the process water pond and to the processing plant, mainly in the milling area. A pump located in the process water feeds the process water distribution network of the mill. Raw water is added to the process water pond through the freshwater tank overflow to compensate for the process water losses. The proposed water supply is sufficient to meet the process plant requirements.

Tailings

Knight Piésold Consulting (“KP”) was commissioned by Robex to undertake detailed design of the TSF, based on work carried out for the 2023 Technical Report and supplementary work and studies carried out since the 2023 design. The proposed TSF is required to accommodate 60 Mt of tailings over a LoM of 10 years, at a rate of up to 0.5 Mt per month (up to 6 Mtpa). The required storage volume for the tailings was calculated using an estimated average in situ dry density of the tailings product of 1.39 t/m3, a particle SG of 2.77 t/m3, and an estimated average in situ void ratio of 1. Tailings will be pumped to the TSF in a slurry comprising 38%-42% solids by mass. The proposed TSF site has been selected as the preferred site for the development of the Kiniero Mine TSF based on the evaluation of the candidate sites. The TSF site was selected due to:

- Reduced rock/earth fill volumes required to construct the main embankment of the TSF.

- Opportunities for phasing allows capital expenditure to be spread over 3 phases.

- The site allows a facility 32m high, fully lined with a downstream raised full-containment wall.

- Elevation to the processing plant is more favourable than other options and avoids a deposition line running over the ridge between the existing TSF and other site options, which is favourable in terms of pumping costs.

- The site would be less exposed during operational and closure phases.

- Rehabilitation and closure of the TSF lends itself to relatively simple closure principles, without long-term storage of water, utilizing existing stormwater diversions to direct surface runoff off the TSF. The relatively smaller downstream embankment surface area for the TSF would require less material for the rehabilitation and vegetation of downstream slopes to the TSF.

The TSF is expected to be constructed in phases as a full containment facility incorporating an high density polyethylene liner to the basin and inside faces of the containment walls to mitigate against the potential for groundwater pollution. Phase 1 will comprise the initial embankment, causeway, interception trenches, diversion channel, collection pond and distribution system. Phases 2 and 3 will comprise downstream lifts for the TSF embankments until the final elevation is reached. Phase 3 will include partial progressive closure and construction of the post closure emergency spillway.

Management and monitoring systems will be implemented to ensure that risks associated with the facility are identified and mitigated in line with accepted practices and standards.

Figure 7: Site Infrastructure of the Kiniero complex

Operating Costs Summary

Mining operating cost estimates were prepared by AMC Consultants (UK) Ltd (“AMC”). Processing costs were prepared by Primero while Infrastructure and General and Administration (“G&A”) operating cost estimates were prepared by Robex. LoM operating unit costs are summarised in the table below.

Table 6: LoM operating unit costs

| Item | Operating costs (US$/t ore processed) |

| Refining and transport charges | 0.05 |

| Mining Costs | 9.0 |

| Processing Costs | 10.6 |

| Maintenance Costs | 0.7 |

| General and Administration | 2.1 |

| Corporate Costs | 1.6 |

| Total | 24.0 |

Capital Costs Summary

The process plant capital cost estimate (“Capex”) was compiled by Primero with input from Knight Piésold on the TSF and Robex on the water infrastructure and site access roads. Robex has provided estimates for mine establishment, infrastructure facilities, high-voltage power supply and owner’s costs.

Starting September 1, 2024, the total LoM Capex is estimated at US$326m, including US$243m of pre-production Capex, US$19m of development Capex post-construction period and US$ 63m of sustaining Capex, as shown in the table below. The pre-production Capex include a 5.8% contingency. The LOM CapEx is summarized in Table 7.

Table 7: Capital Cost Estimate Summary

| Category, in US$k | Pre-Production Capex | Capex during operations | Sustaining Capex over LoM | Total Capex LoM |

| Mining | 29,150 | 1,863 | 31,014 | |

| Process Plant | 104,533 | 104,533 | ||

| TSF | 12,868 | 19,129 | 10,889 | 42,886 |

| Infrastructure | 35,610 | 35,610 | ||

| G&A | 31,117 | 31,117 | ||

| Other costs | 18,968 | 17,771 | 36,738 | |

| Closure costs | 32,856 | 32,856 | ||

| Contingency | 10,961 | - | 10,961 | |

| Total | 243,207 | 19,129 | 63,380 | 325,716 |

The construction has commenced and $41m of the planned Capex has been spent at the end of December 2024.

The closure costs estimate was updated by ABS Africa increasing from $19.9m in 2023 to US$32.8m. This includes increased Preliminary and General Costs, Engineering Design and Environmental Permitting and contingency.

Environment and Social

Under the Mining Code, all applicants for an exploitation licence must submit an Environmental and Social Impact Assessment (“ESIA”). Robex completed the ESIA in 2023. There are currently no known objections to Robex to the development of the Project.

The environmental permit for the Project was received and an Environmental and Social Management Plan (“ESMP”) is being implemented to guide Robex’s local community engagement as well as ensure it fulfils its environmental obligations, minimizing the mine’s impacts where possible. The ESMP Is currently based on the 2023 FS, however, the ESMP Is currently updated with the latest FS project design. The updated ESMP will be used to ensure compliance with environmental specifications, monitoring and management measures and will be implemented from site preparation through to decommissioning and closure.

Robex believes that its most significant contribution to sustainable and responsible development is to help its local employees obtain or complete their professional qualifications, thereby ensuring long careers. Robex intends to replicate the mine-school concept in Guinea from its existing operation in Mali, targeting a >90% local talent of its skilled workforce.

Ownership, Permitting, Taxes and Royalties

Once a mining convention is signed with the Government of Guinea, Robex will have an 85% ownership stake in Kiniero, while SOGUIPAMI (the Guinean state-owned mining company) will have a stake of 15%. Subject to the Government of Guinea’s 15% interest, Robex also has the exclusive rights to full ownership of the Mansounia exploitation license. Robex has submitted an application to the Government of Guinea to convert the licenses into exploitation. Ultimately, Robex will own 85% of Kiniero and Mansounia with the balance owned by the Guinean state. Both properties will be governed by the same mining convention.

Subject to adjustment with a mining convention the corporate tax rate of 30% has been applied in the FS. A royalty rate of 5.5%, a 1% contribution to the Local Mining Development Fund and a 0.5% private royalty were applied to all sales.

FINANCIAL ANALYSIS

An economic analysis has been carried out for the Project using a cash flow model. The model has been constructed using annual cash flows considering annual processed tonnages and grades for the CIL feed, process recoveries, metal prices, operating costs and refining charges, royalties and capital expenditures (both pre-production and sustaining).

The economic model was run at two gold prices; Scenario 1 with gold price of US$1,800/oz used for the Mineral Reserve and Scenario 2 with the S&P consensus long term gold price at end of October 2024, ranging between US$2,431/oz and US$2,320/oz, as shown in Table 8.

Table 8: LoM Gold Price

| LOM Gold Price | Years | 2026 | 2027 | 2028 | Long Term |

Scenario 1 Mineral Reserve | US$/oz | 1,800 | 1,800 | 1,800 | 1,800 |

Scenario 2 S&P consensus gold price (end of October 2024) | US$/oz | 2,431 | 2,314 | 2,320 | 2,320 |

The financial assessment of the Project is carried out on a “100% equity” basis and no provision has been made for the effects of inflation. Discounting and IRR calculations have been applied as of September 1, 2024, using a 5% discount rate.

Project costs included from July 2024 and sunk costs considered pre-July 2024 with commercial production in January 2026.

Table 9 - Costs summary across the LoM

| Across the LoM, starting July 1, 2023 | Total US$M | Unit Cost US$/t ore milled | Costs US$/oz |

| Refining and transport charges | 2 | 0.05 | 2 |

| Mining costs | 407 | 9.0 | 335 |

| Processing costs | 513 | 11.3 | 423 |

| G&A Guinea | 94 | 2.1 | 77 |

| Total Site Costs | 1,016 | 22.4 | 837 |

| Government royalty | 198 | 4.4 | 163 |

| Private royalties | 31 | 0.7 | 26 |

| Total Operating Costs | 1,246 | 27.5 | 1,025 |

| Sustaining costs | 50 | 1.1 | 41 |

| All-In Sustaining Costs | 1,296 | 28.6 | 1,066 |

| G&A outside Guinea | 70 | 1.5 | 57 |

| Development costs | 237 | 5.2 | 195 |

| Closure costs | 33 | 0.7 | 27 |

| Total Costs | 1,635 | 36.0 | 1,346 |

Table 10 - Summary of NPV, IRR and payback at $1800/oz and consensus forward gold price

| Units | US$1,800/oz (Reserve Gold Price) | US$ ~2,330/oz (2024 Consensus gold price*) | |

| Pre-tax returns | |||

| NPV5% | US$M | 480 | 940 |

| IRR | % | 47% | 79% |

| Payback period | year | 2.1 | 1.3 |

| Post-tax returns | |||

| NPV5% | US$M | 322 | 647 |

| IRR | % | 36% | 61% |

| Payback period | year | 2.6 | 1.6 |

The Project value was assessed by undertaking sensitivity analyses using the consensus forward gold price (Scenario 2) on the gold price, operating costs, capital costs and discount rates:

Table 11 - NPV Sensitivity Gold Price

| Gold Price | Pre-tax NPV (US$M) | Post Tax NPV (US$M) |

| (15.0%) | 639 | 434 |

| (7.5%) | 789 | 540 |

| - | 940 | 647 |

| 7.5% | 1,090 | 753 |

| 15.0% | 1,240 | 860 |

Table 12 - NPV Sensitivity Capital Costs

| Capex | Pre-tax NPV (US$M) | Post Tax NPV (US$M) | |

| (15.0%) | 969 | 670 | |

| (7.5%) | 954 | 658 | |

| - | 940 | 647 | |

| 7.5% | 925 | 636 | |

| 15.0% | 910 | 624 | |

Table 13 - NPV Sensitivity Operating Costs

| Opex | Pre-tax NPV (US$M) | Post Tax NPV (US$M) | |

| (15.0%) | 1,056 | 731 | |

| (7.5%) | 998 | 689 | |

| - | 940 | 647 | |

| 7.5% | 881 | 605 | |

| 15.0% | 823 | 563 | |

Table 14 - Discount rate Sensitivity

| Discount Rate | Pre-tax NPV (US$M) | Post Tax NPV (US$M) | |

| 5.0% | 940 | 647 | |

| 7.5% | 816 | 557 | |

| 10.0% | 711 | 481 | |

Qualified Person

Scientific or technical information in this press release that relates to Mineral Resources was prepared or supervised by Mr. Ingvar Kirchner, a full-time employee for AMC Consultants Pty Ltd. Mr Kirchner is a Fellow of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists and has sufficient experience that is relevant to the project under consideration which he is undertaking to qualify as a Qualified Person (“QP”) under NI 43-101.

Scientific or technical information in this press release that relates to geology, exploration, drilling and sample preparation, analyses and security was prepared or supervised by Mr. Nicholas Szebor, a full-time employee for AMC Consultants UK Ltd. Mr Szebor is a Chartered Geologist with the Geological Society of London (CGeol) and the European Federation of Geologists (EurGeol) and has sufficient experience that is relevant to the project under consideration which he is undertaking to qualify as a QP under NI 43-101.

Scientific or technical information in this press release that relates to Mineral Reserves and Mining was prepared or supervised by Glen Williamson, a full-time employee for AMC Consultants Pty Ltd. Mr Williamson is a Fellow and Chartered Professional of the Australasian Institute of Mining and Metallurgy and has sufficient experience that is relevant to the project under consideration which he is undertaking to qualify as a QP under NI 43-101.

The scientific or technical information in this press release that relates to geotechnical engineering was prepared or supervised by Mr. Jody Thompson, founder and principal engineer of TREM Engineering in South Africa. Mr. Thompson is a certified rock mechanics engineer under the Chamber of Mines of South Africa, is a member in good standing with the South African Institute of Rock Engineering, a member of the South African Institute of Mining and Metallurgy and a member of the International Society of Rock Mechanics; he has sufficient experience that is relevant to the commodity, style of mineralization under consideration and activity which he is undertaking to qualify as a QP under NI 43-101.

The scientific or technical information in this press release that relates to metallurgy and processing results was prepared or supervised by Mr. Ryan Cunningham, a full-time employee of Primero. Mr. Cunningham is a member of the Ordre des Ingénieurs du Québec (OIQ) and has sufficient experience that is relevant to the project under consideration which he is undertaking to qualify as a QP under NI 43-101.

The scientific or technical information in this press release that relates to tailings storage facility results was prepared or supervised by Mr. Darren Anthony King, a permanent employee of Knight Piésold Limited (UK) . Mr. King is a Chartered Geologist (Geological Society of London), Chartered Engineer and Environmentalist (Institute of Engineer) and has sufficient experience that is relevant to the project under consideration which he is undertaking to qualify as a QP under NI 43-101.

The scientific or technical information in this press release that relates to environmental, social and governance results was prepared or supervised by Mr. Faan Coetzee, a full-time employee of ABS AFRICA PTY. Mr. Coetzee is a Registered Professional Natural Scientist with the South African Council for Natural Scientific Professions and has sufficient experience which is relevant to the project under consideration which he is undertaking to qualify as a QP under NI 43-101.

Each of Mr. Ingvar Kirchner, Mr. Nicholas Szebor, Mr. Glen Williamson, Mr. Jody Thompson, Mr. Ryan Cunningham, Mr. Darren King and Mr. Faan Coetzee has reviewed and approved the scientific and technical information relating to his respective fields of expertise mentioned above and does not or did not have at the relevant time an affiliation with Robex or its subsidiaries, except that of independent consultant/client relationship. The relevant QP’s have verified the data disclosed including sampling, analytical and test data underlying the information contained in this news release. This included an appropriate quality control sampling program of reference standards, blanks and duplicates to monitor the integrity of all assay results. Raw Quality Assurance/Quality Control (“QA/QC”) data was supplied to the QP that has reviewed the data statistically. Additional checks completed by the QP have included review of historical QA/QC data and review of a selection of assay certificates.

Further details on the scientific and technical information relating to the Kiniero Gold Project will be provided in the technical report for the Kiniero Gold Project which will be filed on SEDAR at www.sedar.com within the next 45 days.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

About Robex Resources Inc.

Robex is a multi-jurisdictional West African gold production and development company with near-term exploration potential. The Company is dedicated to safe, diverse and responsible operations in the countries in which it operates with a goal to foster sustainable growth. The Company has been operating the Nampala mine in Mali since 2017 and is advancing the Kiniero Gold Project in Guinea.

Robex is supported by two strategic shareholders and has the ambition to become one of the most important mid-tier gold producers in West Africa.

For more information

ROBEX RESOURCES INC.

Matthew Wilcox, Chief Executive Officer

Alain William, Chief Financial Officer

+1 581 741-7421

Email: investor@robexgold.com

www.robexgold.com

Forward-looking information and forward-looking statements

This press release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian securities legislation (“forward-looking statements”). Forward-looking statements are included to provide information about Management’s current expectations and plans that allows investors and others to have a better understanding of the Company’s business plans and financial performance and condition.

Statements made in this press release that describe the Company’s or Management’s estimates, expectations, forecasts, objectives, predictions, projections of the future or strategies may be “forward-looking statements”, and can be identified by the use of the conditional or forward-looking terminology such as “aim”, “anticipate”, “assume”, “believe”, “can”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “future”, “guidance”, “guide”, “indication”, “intend”, “intention”, “likely”, “may”, “might”, “objective”, “opportunity”, “outlook”, “plan”, “potential”, “should”, “strategy”, “target”, “will” or “would” or the negative thereof or other variations thereon. Forward-looking statements also include any other statements that do not refer to historical facts. Such statements may include, but are not limited to, statements regarding the perceived merit and further potential of the Company’s properties; the Company’s estimate of mineral resources and mineral reserves (within the meaning ascribed to such expressions in the Definition Standards on Mineral Resources and Mineral Reserves adopted by the Canadian Institute of Mining Metallurgy and Petroleum (“CIM Definition Standards”) and incorporated into NI 43-101; capital expenditures and requirements; the Company’s access to financing (including any project finance facility); preliminary economic assessments (within the meaning ascribed to such expressions in NI 43-101) and other development study results; exploration results at the Company’s properties; budgets; strategic plans; market price of precious metals; the Company’s ability to successfully advance the Kiniero Gold project on the basis of, and achieve, the results projected in the feasibility study (within the meaning ascribed to such expression in the CIM Definition Standards incorporated into NI 43-101) with respect thereto (including economic and production results), as the same may be updated from time to time by the Company; the potential development and exploitation of the Kiniero Gold Project and the Company’s existing mineral properties and business plan, including the completion of feasibility studies or the making of production decisions in respect thereof; work programs; permitting or other timelines; government regulations and relations; optimization of the Company’s mine plan; the future financial or operating performance of the Company and the Kiniero Gold Project; exploration potential and opportunities at the Company’s existing properties; costs and timing of future exploration and development of new deposits;.

Forward-looking statements and forward-looking information are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such statements or information. There can be no assurance that such statements or information will prove to be accurate. Such statements and information are based on numerous assumptions, including: the ability to execute the Company’s plans relating to the Kiniero Gold Project as set out in the feasibility study with respect thereto, as the same may be updated from time to time by the Company ; the Company’s ability to reach an agreement with the Malian authorities to establish a sustainable new tax framework for the Company, and for the sustainable continuation of the Company's activities and further exploration investments at Nampala; the Company’s ability to complete its planned exploration and development programs; the absence of adverse conditions at the Kiniero Gold Project; the absence of unforeseen operational delays; the absence of material delays in obtaining necessary permits; the price of gold remaining at levels that render the Kiniero Gold Project profitable; the Company’s ability to continue raising necessary capital to finance its operations; the Company’s ability to restructure the Taurus USD35 million bridge loan and adjust the mandate to accommodate for the revised timeline of the enlarged project; the Company’s ability to enter into definitive documentation for the USD115 million project finance facility for the Kiniero Gold Project (including a USD15 million cost overrun facility) on acceptable terms or at all, and to satisfy the conditions precedent to closing and advances thereunder (including satisfaction of remaining customary due diligence and other conditions and approvals); the ability to realize on the mineral resource and mineral reserve estimates; and assumptions regarding present and future business strategies, local and global geopolitical and economic conditions and the environment in which the Company operates and will operate in the future.

Certain important factors could cause the Company’s actual results, performance or achievements to differ materially from those in the forward-looking statements and forward-looking information including, but not limited to: geopolitical risks and security challenges associated with its operations in West Africa, including the Company’s inability to assert its rights and the possibility of civil unrest and civil disobedience; fluctuations in the price of gold; limitations as to the Company’s estimates of mineral reserves and mineral resources; the speculative nature of mineral exploration and development; the replacement of the Company’s depleted mineral reserves; the Company’s limited number of projects; the risk that the Kiniero Gold Project will never reach the production stage (including due to a lack of financing); the Company’s capital requirements and access to funding; changes in legislation, regulations and accounting standards to which the Company is subject, including environmental, health and safety standards, and the impact of such legislation, regulations and standards on the Company’s activities; equity interests and royalty payments payable to third parties; price volatility and availability of commodities; instability in the global financial system; the effects of high inflation, such as higher commodity prices; fluctuations in currency exchange rates; the risk of any pending or future litigation against the Company; limitations on transactions between the Company and its foreign subsidiaries; the risk that the listing of the Company’s shares on the ASX is not approved and/or otherwise implemented, and even if it is, that is fails to support the long-term growth of the Company; volatility in the market price of the Company’s shares; tax risks, including changes in taxation laws or assessments on the Company; the Company’s inability to successfully defend its positions in negotiations with the Malian authorities to establish a new tax framework for the Company, including with respect to the current tax contingencies in Mali; the Company obtaining and maintaining titles to property as well as the permits and licenses required for the Company’s ongoing operations; changes in project parameters and/or economic assessments as plans continue to be refined; the risk that actual costs may exceed estimated costs; geological, mining and exploration technical problems; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; the effects of public health crises, on the Company’s activities; the Company’s relations with its employees and other stakeholders, including local governments and communities in the countries in which it operates; the risk of any violations of applicable anti-corruption laws, export control regulations, economic sanction programs and related laws by the Company or its agents; the risk that the Company encounters conflicts with small-scale miners; competition with other mining companies; the Company’s dependence on third-party contractors; the Company’s reliance on key executives and highly skilled personnel; the Company’s access to adequate infrastructure; the risks associated with the Company’s potential liabilities regarding its tailings storage facilities; supply chain disruptions; hazards and risks normally associated with mineral exploration and gold mining development and production operations; problems related to weather and climate; the risk of information technology system failures and cybersecurity threats; and the risk that the Company may not be able to insure against all the potential risks associated with its operations.

Although the Company believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. These factors are not intended to represent a complete and exhaustive list of the factors that could affect the Company; however, they should be considered carefully. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information.

The Company undertakes no obligation to update forward-looking information if circumstances or Management’s estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking information. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and results as at and for the periods ended on the dates presented in the Company’s plans and objectives and may not be appropriate for other purposes.

Please refer to the “Risk Factors” section of the Company’s Annual Information Form for the year ended December 31, 2023, dated April 29, 2024, and to the “Risks and Uncertainties” section of each of the Company’s Management’s Discussion and Analysis dated April 29, 2024 for the years ended December 31, 2023, and the Company’s Management’s Discussion and Analysis dated November 29, 2024 for the three-month periods ended September 30, 2024 and September 30, 2023, all of which are available electronically on SEDAR+ at www.sedarplus.ca or on the Company’s website at www.robexgold.com All forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f78d305f-feb0-452e-864d-d75218fab9d5

https://www.globenewswire.com/NewsRoom/AttachmentNg/29881c9d-6b6c-4dd2-b858-ea21887b4b13

https://www.globenewswire.com/NewsRoom/AttachmentNg/b6431e8a-f512-4908-8957-ce8109d098d2

https://www.globenewswire.com/NewsRoom/AttachmentNg/b71ccca3-2b62-4f60-b371-75d55beee67a

https://www.globenewswire.com/NewsRoom/AttachmentNg/5109f7de-a091-44b9-abf7-ba5952db7f6f

https://www.globenewswire.com/NewsRoom/AttachmentNg/f8908fb5-b2fd-4a81-9b31-a06f68fa4de7

https://www.globenewswire.com/NewsRoom/AttachmentNg/cdbdf8e7-1a58-4537-95dc-b1181157d3df

https://www.globenewswire.com/NewsRoom/AttachmentNg/e46aec9c-ae9a-41fa-b0a1-1c5d299daf08

Subscribe to releases from Globenewswire

Subscribe to all the latest releases from Globenewswire by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Globenewswire

Millicom International Cellular S.A.14.1.2025 22:30:00 CET | Press release

Millicom (Tigo) announces new shareholder remuneration policy

Ingredion Incorporated14.1.2025 22:05:00 CET | Press release

Ingredion to Release 2024 Fourth Quarter and Year-end Financial Results on Feb. 4, 2025

Evaxion Biotech14.1.2025 22:05:00 CET | Press release

Evaxion announces completion of ADS ratio change

Nokia Oyj14.1.2025 21:30:00 CET | Press release

Nokia Corporation: Repurchase of own shares on 14.01.2025

Mobilize14.1.2025 19:56:59 CET | Press release

Mobilize and Autostrade per L’Italia Forge a Strategic Alliance to Power Sustainable Mobility in Italy

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom