Historic Uranium Estimate at Marysvale Project

12.9.2024 08:30:00 CEST | ACCESS Newswire | Press release

Highlights

Historic Resource Estimate is of up to 2.9Mlbs U3O8 within 300-500 feet of the surface1.

Historic Drilling of 115 holes (102 by Phillips Minerals in the 1970s, 13 by Trigon Exploration in 2007).

Potential to double or triple historic estimate.

WOODLAND HILLS, CA / ACCESSWIRE / September 12, 2024 / TONOGOLD Resources Inc. (OTC PINK:TNGL) ("TONOGOLD" or the "Company") and its merger partner, JAG Minerals USA, Inc are pleased to provide an update on the historic resource estimates for their Marysvale Project, Southwestern Utah. This news release provides a detailed summary of the historic data and the future potential.

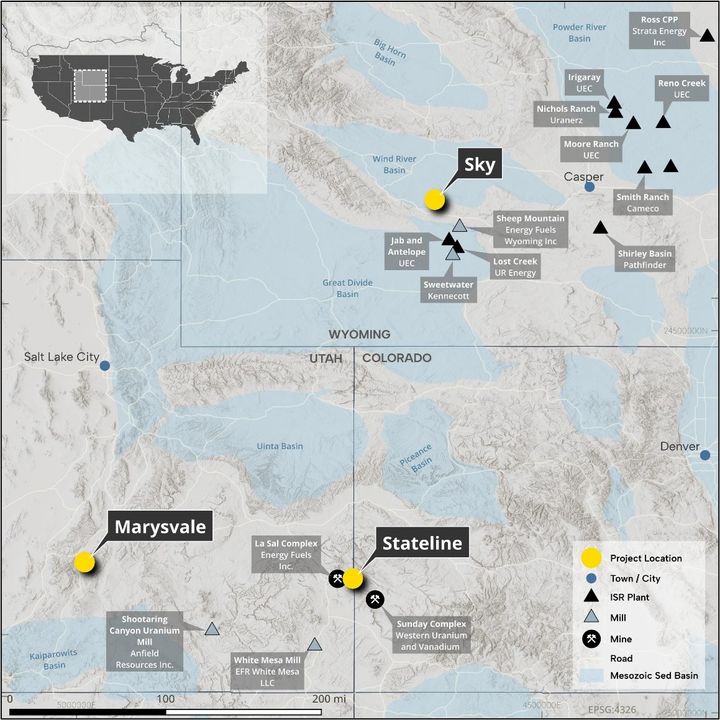

Figure 1: Project and Process Mill locations.

1 Proctor, P.D. (pre-2000). Private Report on the Marysvale Uranium Project. (Referenced in the NI 43-101 report by Havenstrite and Hardy, 2006)

Project Background

The Marysvale Mining District, located in Southwestern Utah, has a rich history of exploration and production. The Company currently holds 20 lode mining claims in this district, strategically positioned adjacent to the historic Central Mining Area. This area produced an estimated 1.39 million lbs. of U3O8 at an average grade of 0.22% from more than 10 mines between 1949 and 19662.

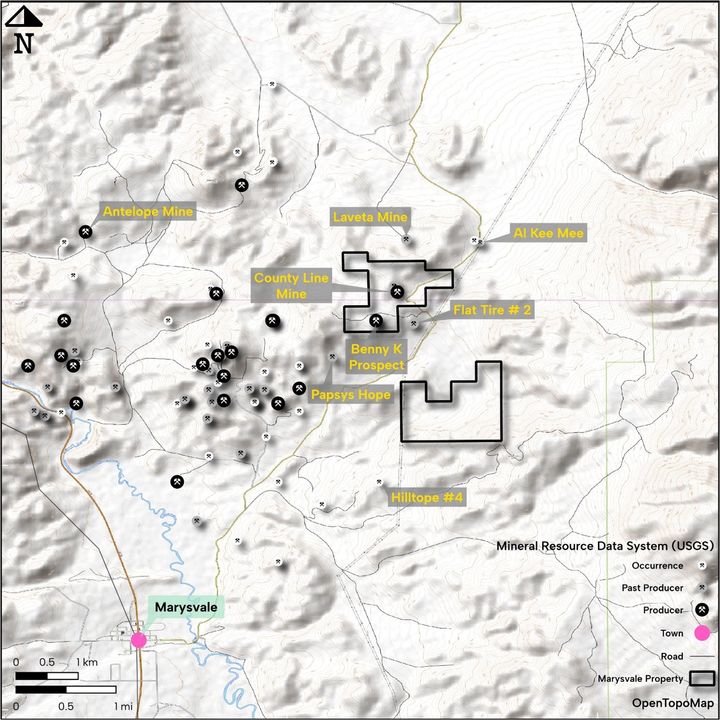

Figure 2: Marysvale Project over USGS deposits.

2 Geology and uranium-vanadium deposits of the La Sal quadrangle, San Juan County, Utah, and Montrose County, Colorado, Carter, W.D., and Gualtieri, J.L. USGS, PP 508, 1965

Historic Drilling

The Marysvale Mining District has a rich history of exploration:

Phillips Minerals (1970s): Conducted 102 drill holes across the district, providing substantial initial data on the mineralization.

Trigon Exploration (2007): Added 13 drill holes, which confirmed and expanded upon the data collected by Phillips Minerals.

Notable Drill Intercepts:

Hole 24-91: 88.0 ft @ 0.07% eU3O8 (equivalent U3O8)

Hole 24-105: 47.5 ft @ 0.13% eU3O8

Hole 24-28: 64.5 ft @ 0.09% eU3O8

Hole 24-20: 45.5 ft @ 0.12% eU3O8

Hole 30-4: 56.0 ft @ 0.07% eU3O8

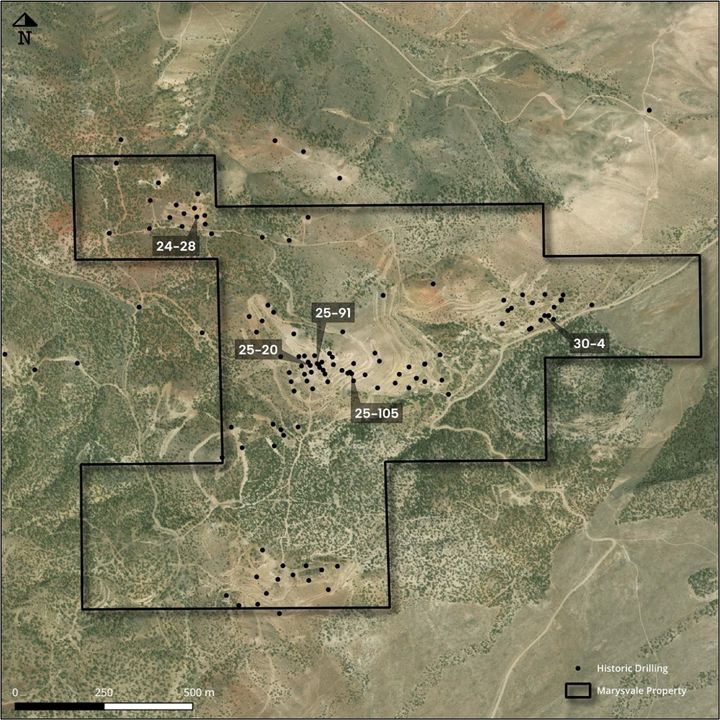

Figure 3: Historic Drilling on Marysvale Property.

Historic Resource Estimate

The Proctor Report, prepared by Paul Dean Proctor, PhD., a professor of geology at Brigham Young University, provides a historical estimate of uranium reserves at the Marysvale Project based on drilling conducted by Phillips Uranium Company in the late 1970s and early 1980s. Although this estimate predates National Instrument 43-101 standards and current US SEC Regulation S-K reporting standard and is not compliant with modern requirements, it offers valuable insights into the potential size and grade of uranium deposits at the site.

Historical Estimate of Uranium Reserves

Total Estimated Reserves: At least 2.9 million lbs. U3O8.

Grade and Tonnage:

0.75 million tons at 0.075% U3O8 (1.125 million lbs. U3O8).

3.0 million tons at 0.03% U3O8 (1.8 million lbs. U3O8).

Depth: Mineralization occurs within 300-500 feet of the surface.

Potential for Expansion

Proctor suggests that additional potential uranium ore exists on the property, which could double or triple the current reserves. This is based on gamma ray (eU) anomalies detected over a large alteration system along a major northwest-trending fault zone.

Drilling Data

The Proctor Report references drill intercepts from Phillips Uranium Company's drilling program, including intervals such as "25 feet of 0.22% and 15 feet of 0.50% U3O8." These intercepts indicate significant primary uranium mineralization below the zone of secondary minerals.

Survey Data

A surface radiometric survey conducted by Phillips in 1981 detected areas of anomalous radiation (>200 counts per second), although the correlation with argillic alteration zones was imperfect. Locations of these anomalies remain unknown, but they indicate potential targets for further exploration.

Conclusion

The Proctor Report provides a detailed historical perspective on the Marysvale Uranium Project, highlighting significant uranium mineralization and the potential for resource expansion. Although the data predates modern standards, it underscores the importance of further exploration to fully realize the property's potential. The Company has not yet independently validated or confirmed the historic resource estimates under current reporting and disclosure standards.

Reference:

Proctor, P.D. (pre-2000). Private Report on the Marysvale Uranium Project. (Referenced in the NI 43-101 report by Havenstrite and Hardy, 2006)

Geology and Mineralization

Favorable Geology: The property lies within the Cenozoic Marysvale volcanic field, astride the transition zone between the Colorado Plateau and the Great Basin.

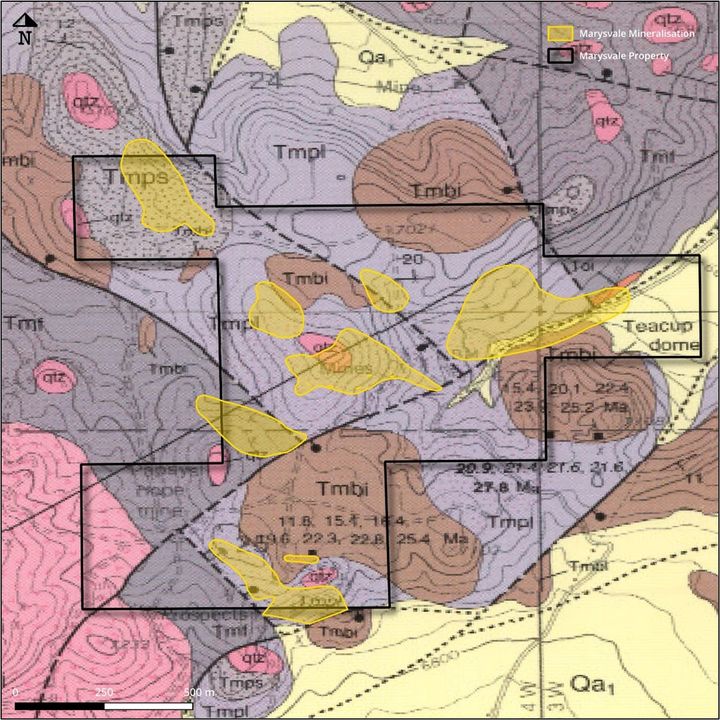

Figure 4: Marysvale Geology with interpreted mineralization from historic drilling.

Mineralization Depth: Uranium mineralization occurs from the surface to a depth of approximately 500 ft in strongly clay-altered rhyolitic volcanics.

Structural Control: Mineralization is structurally controlled within fault blocks, making it favorable for both surface and underground mining methods.

Mineralization remains open-ended, suggesting further potential for resource expansion.

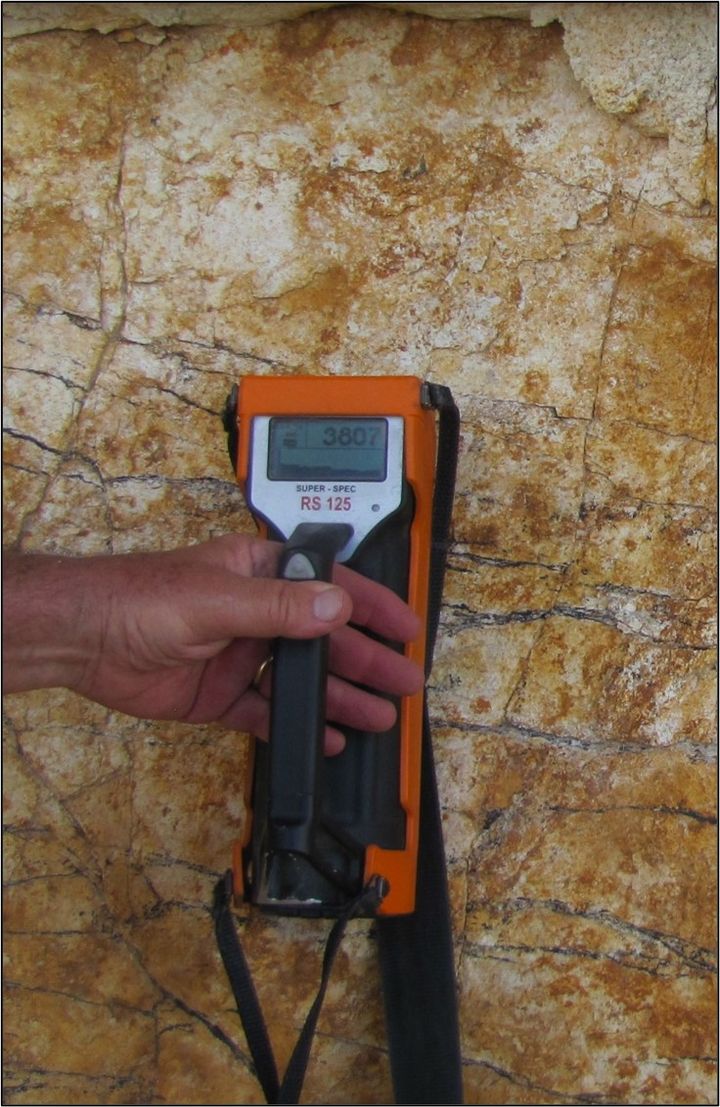

Figure 5: Outcrop sample SL06 field photo (RS-125 unit returned 45,200 cps).

Figure 6: Using the RS-125 to get elevated cps values on the tree for comparison against the surrounding counts.

Future Plan

Enhance the project's value by advancing the understanding and resource base through targeted drilling and gamma logging of 15-20 holes with geochemical analysis to define disequilibrium and test extensions. Update the NI 43-101 Technical Report with these findings, and strategically focus exploration efforts on delineating and expanding the known mineral inventory, emphasizing bulk tonnage supergene deposits and higher-grade vein deposits.

TONOGOLD CEO William Hunter stated: "During the 2023 geological field season JAG Minerals USA, Inc. was active in expanding its Uranium and Vanadium claims in Wyoming, Utah and Colorado. Specifically focused on claims that have detailed historic Uranium data and / or published resources open for potential expansion. Further, the areas need access to mills to process the mined Uranium products. This development is very positive to the combined Company and will be very positive for the Company in the recently announced transaction JAG Minerals USA, Inc.

Disclaimer Regarding Historic Estimates

The historical resource estimates provided in this release are based on data obtained and prepared by previous operators and have not been verified by either the Company or a qualified person as defined by NI 43-101 or in US SEC Regulation S-K and the rules promulgated thereunder regarding the reporting of historical resource estimates. These estimates are considered historical and do not conform to current NI 43-101 standards or to current US SEC reporting standards. A qualified person has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves, and the Company is not treating these historical estimates as current mineral resources or mineral reserves. Further work, including drilling and analysis, is required to verify these historical estimates and upgrade them to meet NI 43-101 standards and current US SEC reporting standards.

This estimate was made prior to implementation of National Instrument 43-101 standards and prior to the implementation of current US SEC Regulation S-K and related reporting standards, and does not qualify as a resource or reserve, and thus, the historical estimate should not be relied upon.

Qualified person

Mr Andrew Hawker, BSc. Geol, MAIG, is a member of the Australasian Institute Geoscientists, is a consultant to JAG Minerals USA, Inc. and is a Qualified Person as defined in National Instrument 43-101. Mr Hawker is in charge of exploration programs and has reviewed and approved the technical information contained in this news release.

Enquiries

For further information, please contact:

William Hunter

Interim CEO Tonogold Resources Inc

M: +1 203 856 7285

E: bhunter@tonogold.com

SOURCE: Tonogold Resources, Inc.

View the original press release on accesswire.com

Tonogold Resources, Inc.

Subscribe to releases from ACCESS Newswire

Subscribe to all the latest releases from ACCESS Newswire by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from ACCESS Newswire

Datavault AI Announces Anticipated Launch of Josh Gibson Stablecoin and Josh Gibson NIL Strategies for Its Forthcoming NIL Exchange20.2.2026 14:08:00 CET | Press release

PHILADELPHIA, PA / ACCESS Newswire / February 20, 2026 / Datavault AI Inc. (NASDAQ:DVLT) ("Datavault AI" or the "Company"), a leader in data monetization, credentialing, digital engagement and real-world asset (RWA) tokenization technologies announced today the anticipated launch of the Josh Gibson Stablecoin and dedicated Josh Gibson Name, Image, and Likeness (NIL) strategies for its forthcoming sports and entertainment focused NIL digital asset exchange. This initiative builds directly on Major League Baseball's (MLB's) historic integration of Negro Leagues (1920-1948) statistics into the official major league record and celebrates Black History Month by honoring the legacy of baseball icon Josh Gibson. As outlined in the MLB's May 2024 press release, the statistics of the Negro Leagues have officially entered the major league record, recognizing the achievements of thousands of black players previously excluded from MLB. Josh Gibson, widely regarded as one of the greatest catchers a

Masterminds Education Named "Most Nurturing Early Education Environment" at UAE Business Awards 2026; Standardizes Early Learning Model with 12-Student Class Cap Structured as Two Learning Groups of Six20.2.2026 08:35:00 CET | Press release

Dubai-based provider marks 10 consecutive years of recognition and reinforces a whole-child program delivered through ultra-small learning groups DUBAI, AE / ACCESS Newswire / February 20, 2026 / Masterminds Education announced today that it has been recognized at the UAE Business Awards 2026 with two honors: Most Nurturing Early Education Environment 2026 and Child Development Excellence Award 2026. The awards extend Masterminds' record of 10 consecutive years of recognition and reinforce the organization's focus on high-impact early education built on consistency, relationships, and outcomes. As part of strengthening the operating conditions behind the "Most Nurturing" recognition, Masterminds Early Learning Center in Dubai announced an optimization to its early education structure: beginning in the 2026-27 academic year, the Early Learning Center will operate with a maximum class size of 12 students across Preschool through KG2, organized as two learning groups of six within each cl

Polaris Renewable Energy Announces Q4 and Annual 2025 Results19.2.2026 13:50:00 CET | Press release

TORONTO, ONTARIO / ACCESS Newswire / February 19, 2026 / Polaris Renewable Energy Inc. (TSX:PIF) ("Polaris Renewable Energy" or the "Company"), is pleased to report its financial and operating results for the year ended December 31, 2025. This earnings release should be read in conjunction with the Company's consolidated financial statements and management's discussion and analysis, which are available on the Company's website at www.PolarisREI.com and have been posted on SEDAR+ at www.sedarplus.ca. The dollar figures below are denominated in US Dollars unless noted otherwise. HIGHLIGHTS For the quarter ended December 31, 2025 consolidated energy production increased by 1% when compared to the same quarter in 2024, while annual consolidated energy production was 810,731 MWh for the year ended December 31, 2025 versus 764,756 for the year ended December 31, 2024. The Company generated $80.5 million in revenue for the year ended December 31, 2025, compared to $75.8 million in the same pe

Honoring Nelson Mandela's Legacy of Financial Empowerment and Inclusion19.2.2026 13:47:00 CET | Press release

Datavault AI and Nelson Mandela Family Members, Re Mandela Dlamini & Manaway L.L.C., Announce Formation of Mandela Digital Ventures to Develop Digital Asset Products Aligned with the Legacy of Nelson Mandela PHILADELPHIA, PENNSYLVANIA / ACCESS Newswire / February 19, 2026 / Datavault AI Inc. (NASDAQ:DVLT) ("Datavault AI" or the "Company"), a leader in data monetization, credentialing, digital engagement and real-world asset (RWA) tokenization technologies, and Mandela Dlamini & Manaway L.L.C., a Wyoming based organization dedicated to perpetuating Nelson Mandela's vision of equality and human dignity, today announced a strategic joint venture, Mandela Digital Ventures to develop and launch a new suite of digital asset products. The collaboration will create blockchain-based financial tools and assets, designed to drive financial inclusion for underserved populations worldwide. These products will directly reflect the enduring values of Nelson Mandela: freedom, justice, reconciliation,

From Seoul's Global K-Wave to Web3 Leadership: Datavault AI and TBURN Chain Align K-Pop, Esports, and Korean Cultural Exports with Enterprise-Grade Data Asset Infrastructure and Tokenized Real World Assets18.2.2026 13:00:00 CET | Press release

PHILADELPHIA, PENNSYLVANIA / ACCESS Newswire / February 18, 2026 / Datavault AI Inc. (NASDAQ:DVLT) ("Datavault AI" or the "Company"), a leader in data monetization, credentialing, digital engagement and real-world asset (RWA) tokenization technologies, today announced the execution of a collaboration agreement with TBURN Chain Foundation ("TBURN"), a high-performance blockchain infrastructure platform. The agreement establishes a strategic framework to explore integration of Datavault's data asset tokenization, valuation, and Information Data Exchange® (IDE) technologies with TBURN's high-throughput blockchain network, which is designed to support enterprise-scale transaction processing and near-instant settlement. TBURN is engaged across global esports and entertainment ecosystems, including partnerships involving esports champion Faker and K-Pop acts such as BLACKPINK, providing potential pathways for authenticated digital engagement and data-driven monetization models. Originating f

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom