Columbus delivers 14% revenue growth in Q1 2024

Columbus is well off to a good start in 2024 with 14% growth in Q1, primarily driven by the strong performance in the Cloud ERP business and a positive development in the Danish and UK markets, which have more than compensated for the uncertainty in the Norwegian and Swedish markets. Columbus has thus achieved a satisfactory result and maintains the financial expectations for the year.

"We came off to a good start to the year driven by strong performance in our Cloud ERP business. Our customers’ focus on safeguarding critical business systems is currently reshaping demand, thus underlining the strength of our end-to-end portfolio of services enabling us to match the changing market demands”, says CEO Søren Krogh Knudsen.

The first quarter of 2024 marked the beginning of Columbus’ new strategy, “New Heights”. We have been focused on implementing strategic growth initiatives and balancing the different market sentiments.

Satisfactory EBITDA development

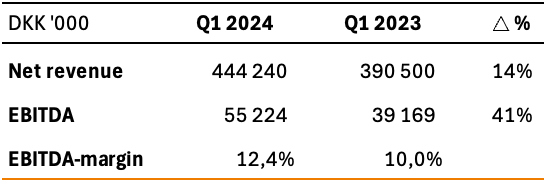

In Q1 2024, Columbus realized DKK 444m in net revenue, a growth of 14% (11% organic) primarily driven by a strong development in Cloud ERP, accounting for 75% of the revenue in Q1 2024. The operating profit (EBITDA) was DKK 55m, corresponding to an EBITDA margin of 12,4%, or 7.9% excluding the net gain of DKK 20m from the legal procedure against M3CS. Despite challenges in the Security Business Line and the early Easter holiday in March, the EBITDA development was in line with expectations.

Cloud ERP drives growth

The revenue growth in Q1 2024 is primarily driven by strong development in Cloud ERP; The Business Line Dynamics showed continued revenue growth, delivering 17% across most Market Units. The Business Line M3 delivered a growth of 15% which is a strong result after a challenging period. Cloud ERP accounted for 75% of the revenue in Q1 2024.

Columbus’ Business Lines Digital Commerce (-9%) and Data & AI (-3%) were impacted by market uncertainty in Sweden and Norway, as most of their revenue comes from these markets. The Business Line Customer Experience & Engagement delivered a growth of 25%, primarily driven by Denmark and Sweden. Security which was acquired 1 April 2023, delivered below expectations, thus cost and sales initiatives have been initiated to improve performance.

Strong development in the Danish and UK Market Units

The Market Units in the UK and Denmark continued delivering strong progress in Q1 2024. The UK delivered an impressive 65% growth, including the newly acquired company Endless Gain. Organically, the UK Market Unit delivered a significant growth of 50%, primarily driven by Dynamics and Digital Commerce. Denmark delivered a growth of 35%, primarily driven by Dynamics and M3. Excluding the acquisition of ICY Security in April 2023, Denmark grew by 26%.

The largest Market Unit, Sweden, was at the same level as in Q1 2023 delivering 1% growth with good progress in M3 and Customer Experience & Engagement. The Norwegian Market Unit is declining by 8% after a long period of strong growth. The Swedish and the Norwegian Market Units are experiencing some reluctance from our customers to commit to and start new engagements.

Focus on integrating Endless Gain

1 January 2024, we welcomed our new Endless Gain colleagues in the UK and India. The integration process is close to being completed, and the business has demonstrated solid performance in Q1 2024 with a promising outlook.

Creating value for life science companies

As part of the “New Heights” strategy, Columbus has taken a strategic step to enter a new growth industry – life science. Columbus already services a range of customers in the industry which has great synergies with existing customers in the food manufacturing industry. In Q1 2024, Columbus has established a global Life Science industry team to drive the development and progress of the initiative, covering the go-to-market strategy, sales enablement, and partnerships.

“With a strategic focus on the life science industry, we enhance our joint efforts across Columbus to target our sales activities and develop new services that create value for life science companies”, says Søren Krogh Knudsen. ”

Financial expectations maintained

Based on the development in Q1 2024, Columbus maintains its financial expectations for the year with organic revenue growth of 8-10% and EBITDA-margin of 9-10%.

Columbus will continue to monitor the geopolitical situation and its influence on investment appetite and initiated projects, confident in its strong proposition in the current business climate.

Link to Interim Report Q1 2024: https://ir.columbusglobal.com/news-releases/news-release-details/interim-report-q1-2024

Nøgleord

Links

Følg pressemeddelelser fra Columbus Global

Skriv dig op her, og modtag pressemeddelelser på e-mail. Indtast din e-mail, klik på abonner, og følg instruktionerne i den udsendte e-mail.

Flere pressemeddelelser fra Columbus Global

Infor and Columbus announce strategic partnership in Benelux20.6.2025 14:45:39 CEST | Pressemeddelelse

Successful collaboration in the Nordics and Germany forms foundation for accelerating digital transformation in food and beverage, distribution, manufacturing and fashion industries Infor, a global leader in industry-specific cloud software, and Columbus, a leading company in digital transformation, announce a strategic partnership in the Benelux region. Building on a proven track record of success in the United States, Northern Europe and Germany, this collaboration aims to drive business value in the food and beverage, distribution, manufacturing, fashion and retail sectors.

Columbus grows EBITDA by 32% in Q1 20258.5.2025 09:23:10 CEST | Pressemeddelelse

Columbus delivered a solid start to 2025, driven by improved earnings, confirming the robustness of the company’s strategy and business model. Despite a slight decline in revenue, the company achieved a 32% improvement in EBITDA and significantly strengthened its profitability, increasing the EBITDA margin to 10.7% compared to 7.9% in Q1 2024, adjusted for the extraordinary gain of DKK 20m from the M3CS legal case.

Columbus expands in Sweden with key strategic hires29.4.2025 13:02:25 CEST | Pressemeddelelse

Columbus continues its growth journey in Sweden with three strategic hires, aimed at accelerating the development of its Data & AI business area and People support function. By welcoming Susanna Salwén as the new People Director in Sweden, Anna Sandell as the new Head of Data & AI in Sweden, and Jens Noring as Sales Manager for Data & AI Sweden, Columbus reinforces its leadership in the digital transformation of Swedish industry and commerce.

Columbus delivers solid growth and strengthened cash flow in 202413.3.2025 09:50:04 CET | Pressemeddelelse

Columbus continued its positive momentum in 2024 with a revenue growth of 8% to DKK 1,659m and a 30% increase in EBITDA to DKK 153m. The decline in the Swedish and Norwegian markets was more than compensated for in the Danish and English markets, and with a sharpened strategic focus and continued strengthened cash flow, Columbus is well-positioned for the future.

Columbus awarded Medius EMEA Partner of the Year 202411.2.2025 13:00:53 CET | Pressemeddelelse

Medius, a global supplier of cloud-based source-to-pay solutions, has the pleasure of announcing Columbus, an IT services and consulting company, the 2024 Medius Partner of the Year.

I vores nyhedsrum kan du læse alle vores pressemeddelelser, tilgå materiale i form af billeder og dokumenter samt finde vores kontaktoplysninger.

Besøg vores nyhedsrum